The lunch topic could easily be thrown into the ‘Eating Out’ post. But I have reason to believe that ‘Lunch’ warrants it’s own post. The truth is, the cost of eating lunch out is a sneaky one. It’s one that’s easily justified. And one that keeps you in the workforce for much longer than you need to be.

In the course of my adult life to date, I knew very few people who packed their lunch. In high school, my parents packed my lunch for me every day. But when I went to college, I didn’t grocery shop much. I sure didn’t take the time to pack my own lunch each morning before class. And before I knew it, 4 years went by and I can’t think of a single time that I didn’t eat out for lunch.

This habit continued into my first year of adult work. I graduated from OU and went straight into the Finance department at ONEOK in Tulsa, OK. Ironic that I was working in as a Financial Analyst in the Credit department, while each day I was walking down the street to Jimmy Johns and putting a quick $10 on my credit card Monday through Friday.

The problem is – never before in my life had I felt more justified in buying my lunch out. I was making money now! ‘Self-sufficient’. Single and working full time in a great job. I had more money than I knew what to do with! Heck, I was renting a bedroom from a friend of mine for $100 a month, if you can even believe that.

And the embarrassing thing is, I did so little to procure a solid financial future during that time. But that’s exactly why I feel so motivated to write these words. It does not matter how much money you make. If you don’t have a defensive plan to keep as much as possible, you will spend every single dime.

San Francisco Called

After my time at ONEOK, I moved to San Francisco, CA where my rent was a little bit more expensive. (Said very sarcastically.) During this time, I drove for Lyft and pinched my pennies by eating most meals at home. Then, as soon as I landed another salaried position, I was back to my old ways. And it’s worth noting that this decision to move to San Francisco without a job lined up caused me to burn through my relatively meager savings. It was a humbling moment when I wrote a check for my share of a deposit and first month’s rent for $3,000.

From my very first day at Funding Circle, I ate out for lunch every single day. But believe me, if you knew the sandwich shop I frequented, you’d be more understanding about dropping $9 every day on a Dutch Crunch California Veggie with Dijon Mustard. And if you find yourself in need of a great sandwich while in the Telegraph Hill area, RJ’s Market on Sansome is the place.

I eventually left Funding Circle and got a remote work job with a company called SONO. And while I could have worked from home, I decided to get a co-working space downtown so as to continue a normal work routine. And, as I’m sure you could guess by now, the lunches out continued. It was part of my routine and I wasn’t about to break it now.

Remember! I was working. I was making money. Why can’t I treat myself on work days? The last thing in the world on my mind was the cost of my eating lunch out habit.

I justified eating lunch out 5 days a week from 18 to 28. Was there a day or two where lunch was provided by work? Of course. Was there a day or two where I brought my lunch from home? Yes, but very rarely and only after I moved back to Tulsa which wasn’t until I was 26.

That’s 10 years of eating lunch out 5 days a week. I’m not even going to go after coffee out or dinner out. We are just talking lunch here.

Why Lunch Out Is So Easy

Now, this is all to say that many of us, myself included as you can now see, tend to justify this expense especially on the days we are generating income. And it makes sense! We get to leave the office, get outside, take a walk, get something tasty! What’s not to like!

Let’s end the anecdote now and talk dollars and cents. I mean, that’s why we are all here, right? Let’s get a feel for what I gave up to have my tasty sandwich, chips, and chocolate chip cookie every day. Yes, you better believe I was always getting a cookie when the opportunity presented itself.

The Cost of Eating Lunch Out

I’d like to use myself as a real world example here. For 10 years, I decided that instead of taking 50 dollars each week and putting it into the stock market, I should use it to buy lunch 5 days a week. 10 years my friends. That’s a long time. And, this sounds like a job for the Frugal Feline Future Value calculation.

Frugal Feline Future Value

It’s much easier to run the numbers when it’s not so personal. I can’t help but think this one is going to really stick with me for a while. The true opportunity cost of eating out has probably added years to my pre-retirement work life.

Let’s get on with it.

I will first be calculating what I would have in an investment account right now if I had forgone my lunches out and invested that money. In order to do that, I’ll need to assume that the average cost of making my own lunch is $4. It could be higher if you’re packing Filet Minon. Or it could be lower if you’re throwing a cup of Ramen in there. Personally, I don’t think our health is worth sacrificing for money, so I’ll stick with the safe $4 number.

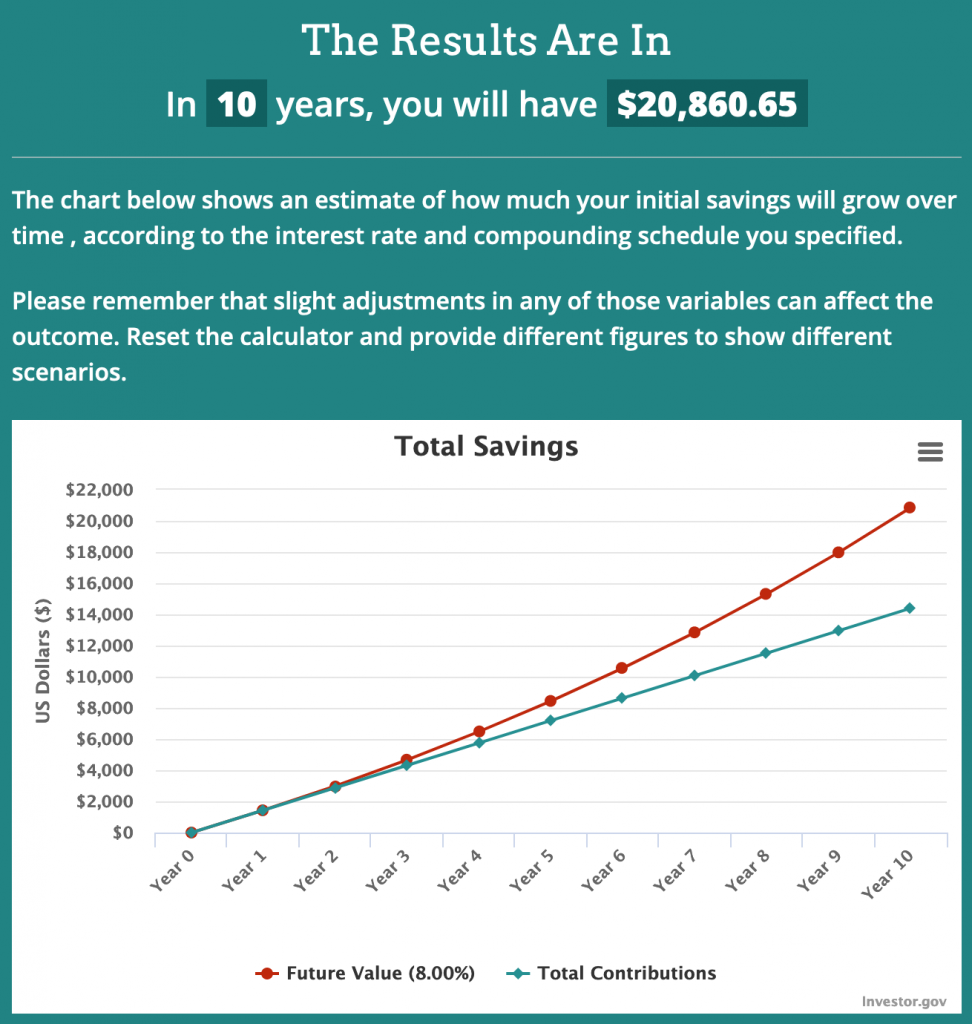

Using this assumption, I could have been saving $30 a week or $120 a month. ($50 spent eating out minus $20 spent packing my own lunch.) Had I taken this $120 and put it into an investment account that tracks the S&P500 for example, I would have realized on average at least an 8% return and I would now have:

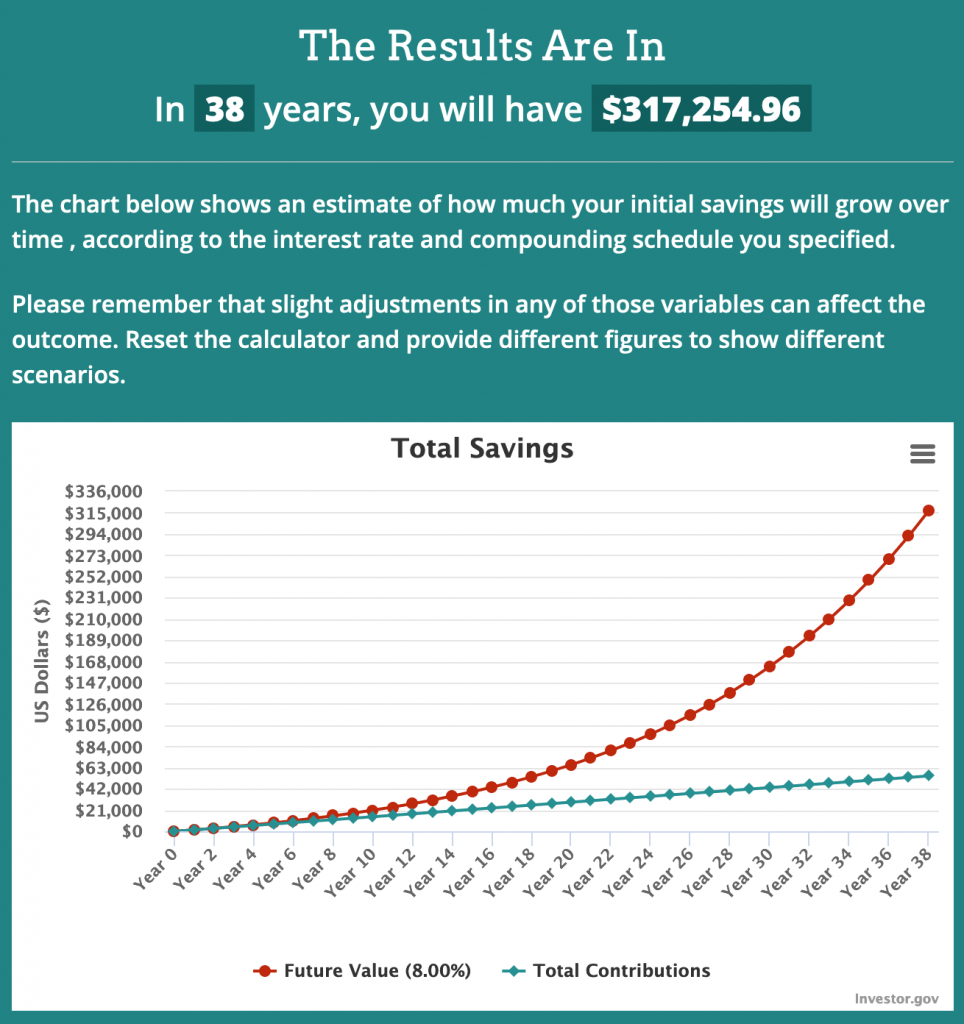

While this number isn’t jaw dropping. Let’s see what this could have been over a 38 year period instead. As we know, the longer the money is in the market, the more time the magic of compound interest has to work.

It’s important to note here and to really comprehend that we are seeing two different types of growth here. Linear growth and exponential growth. Our contributions grow linearly because each month we are putting in $120 (Blue straight line). But our total value in the market is growing exponentially (Red curved line upward).

A Piece of the Pie

Should we be impressed by this dollar figure? I guess not. But again, we are trying to find little behavior modifications that give us the ability to stash away large amounts of our income into the market. We aren’t looking for the one single silver bullet that will give us an early retirement.

The 38 year future value of packing your lunch might only be $317,000 but add the future value of bringing coffee from home $166,000 and now we are looking at almost half a million dollars just from lunch and coffee habit changes alone.

The Cost of Eating Lunch Out $317,254

It’s disappointing to know that by packing my own lunch for the last 10 years I could have over $20k in the market right now. Even more disappointing that this number would be exponentially higher given more time to grow.

I think it’s just worth remembering that no single savings hack is going to work the same for everyone, nor will everyone be willing to give up a certain behavior in life. The only thing we have to do is pick a few that we can achieve and sustain which gives us the money at the end of the month to plunge into an investment account that grows.

I know how hard it is to say no to that Chipotle burrito. It’s a habit I am finally breaking at 28 years old. But for many reading this, you have the chance to get way ahead of the curve and get your money into the market much earlier.

I hope this has shed some light on the cost of eating lunch out. I know for me, I would like to have some of this money in my investment account and not just down my throat and out my… well, you know.

Signing off,

The Frugal Feline.

Pingback: Save Money on Groceries - The Frugal Feline

Pingback: The Naughty 3 Expenses - The Frugal Feline

Pingback: How to Track Expenses - The Frugal Feline

Pingback: A Beer Is More Expensive Than a MacBook Pro - The Frugal Feline

Pingback: The 3 Biggest Wealth Destroyers - The Frugal Feline

Pingback: What Is Lifestyle Inflation? - The Frugal Feline