If there was ever a category of item that we felt justified in spending money, books would be it. Our parents begged us to read as kids. We were forced to read as students. And now as adults, if we find ourselves interested in a book, we can have it on our doorstep by 8AM the following day. Thanks, Amazon. Saving money on books is not going to make or break our savings strategy. But it is another example of making a convenience sacrifice for a certain financial future that most people don’t have. Let’s talk about saving money on books.

Saving Money on Books

You’ve probably heard someone say that if you want to live longer, you should start flossing. Don’t quote me on the science here, but it’s more likely that this relationship is simply a correlation. Meaning, people who floss are probably also likely to get 8 hours of sleep, eat their veggies, and exercise each day. I’d love to see the science that proves that flossing causes longevity, but I don’t think it’s there.

Saving money on books is a lot like flossing. It’s probably not going to be the sole determinant of your future nest egg. But if you’re willing to do something as seemingly inconsequential as trying to save money on your books, you’re probably going to do all the other small things that add up to big savings in the end. So, let’s talk about saving money on books.

Why Save Money On Books

Convenience is a hot commodity in our day and age. It’s what sells Netflix subscriptions, door dash meals, and Uber rides. Convenience is getting sold to us all the time. And convenience is awesome! But it’s not free. Just like buying books on Amazon is extremely convenient, but it’s not free.

Historically, I always just bought the books on Amazon that I wanted to read. I didn’t think twice about it! It’s an investment in myself! But what I didn’t realize is, I was spending a lot of money to save a little bit of my time. And that’s an important thing to remember – money is not our only currency on this earth. Time is a currency too.

Part of moving towards financial independence is deciding that we aren’t going to completely optimize our life for time anymore. But this is actually kind of counter-intuitive. It’s more like we are investing our time for a greater time payoff in the future. What I mean is, deciding to spend more time doing things and give up some convenience today can put us in a position to have much greater time and convenience in the future.

Riding our bike to work might suck, but if it means we get to retire earlier, then maybe it’s a worthy trade to sacrifice some time and convenience today for a better future. This is the mindset that I’m finding myself slowly switching to. I over optimized for maximizing my free time and that, my friends, is an expensive habit.

How To Save Money On Books

It’s so simple. But it requires many of us to break our existing habit loops. Here’s my old habit loop. One that I actually almost fell prey to yesterday when I wanted to read The Richest Man in Babylon.

The Amazon Book Purchase Habit Loop

- Realize I want a book

- Get on Amazon and find it

- Purchase it

- 50/50 chance I read the entire thing

- Sits on my shelf until I give it away a year later

But I stopped myself at step 3 and realized that even though this book was only $5, I could probably find it at my local library. So, I changed my habit loop to this.

The Library Rental Habit Loop

- Realize I want a book

- Get on my local library website and find it

- Place a hold on it

- Ride my bike to go get it

- 50/50 chance I read the entire thing

- Sits on my shelf until I realize I need to return it

Realize that in the first habit loop, we spend money in exchange for convenience. But in the second habit loop, we only have to spend our time. And this is one of the biggest things about financial independence. We voluntarily give up convenience for more time. And we have to spend more time to perpetuate our ability to have more time. It’s kind of wordy, but it’s a core part of this whole mindset change.

Stop thinking you’re too rich or make too much money to spend time doing things that save you money. Save your convenience for the future. You can’t have both total convenience and early retirement. It just doesn’t work like that.

How Much Can We Save On Books?

Now, no post would be complete without talking the dollars and cents of our behavior change. And it’s important to remember that the name of the game here is getting more of our money in the market. Not optimizing our time. Yes, I know it’s inconvenient to go to the library. I know it’s inconvenient to return the book when you’re done. But that’s the whole point here. Decide where you’re willing to give up convenience in exchange for financial independence. Because the truth is, the more you can reduce your monthly expenditures, the easier you can reach financial independence.

Would we rather ride our bikes to the library? Or get in our cars and go to work today? For me, I’ll take the ‘inconvenience’ of a pleasant ride to the library over having to work on crap that I don’t care about any day. Trust me, I’ve been there. Staring at a computer in a cubicle on the 14th floor? Or riding my bike in 75 degree sunshine to the library?

Again, getting off topic here, but this point is so critical. We have to stop framing every decision in the light of whether it’s convenient or not.

Frugal Feline Future Value

So, say we decide that we are going to give up the convenience of buying our books on Amazon. Now we are going to commit to going to the library to get our books. First, we will look at reading one book a month. Then three.

Good news is, the library is free so our decision to change this habit will free up the entire average cost of a book for our savings. Let’s call the average price of a book $20. I know, I know, they can be much less. But they can also be much more! Trust me, my wife is in a book club. And I think this is a more accurate middle ground when considering that audio books are more expensive across the board. (Cost of convenience, remember?)

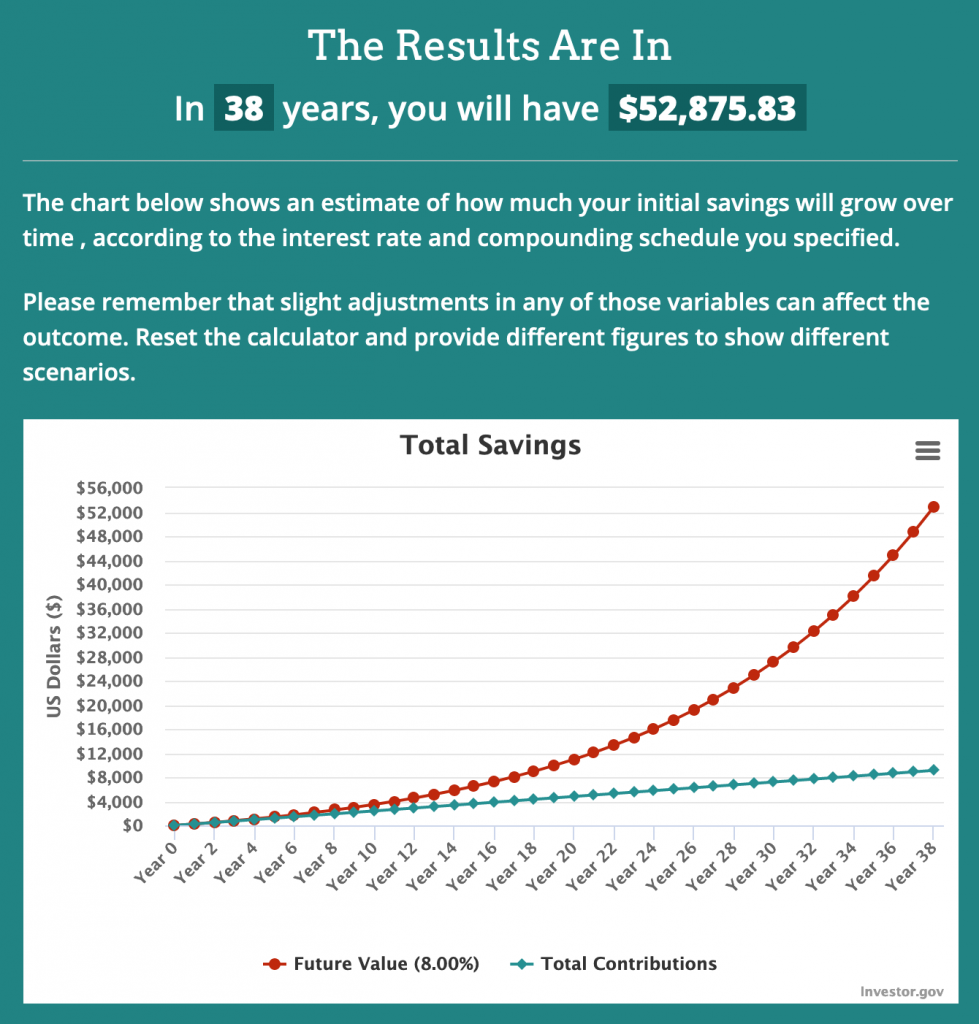

Say we take this $20 saved and invest it in the market for the next 38 years, at the end of this time, we will have….

So investing our $20 a month in an index fund for example would give us $52,875 at the end of 38 years. This is one book a month of savings. Say you’re annual spending is 40k and you’re working toward financial independence, you need roughly $1,000,000 in savings in order to be financially independent. Realize that this one decision has already put you over 5% of the way to your goal. That’s 1/20th! Come up with 19 other behaviors you’re willing to change and you’ll be financially independent in 38 years.

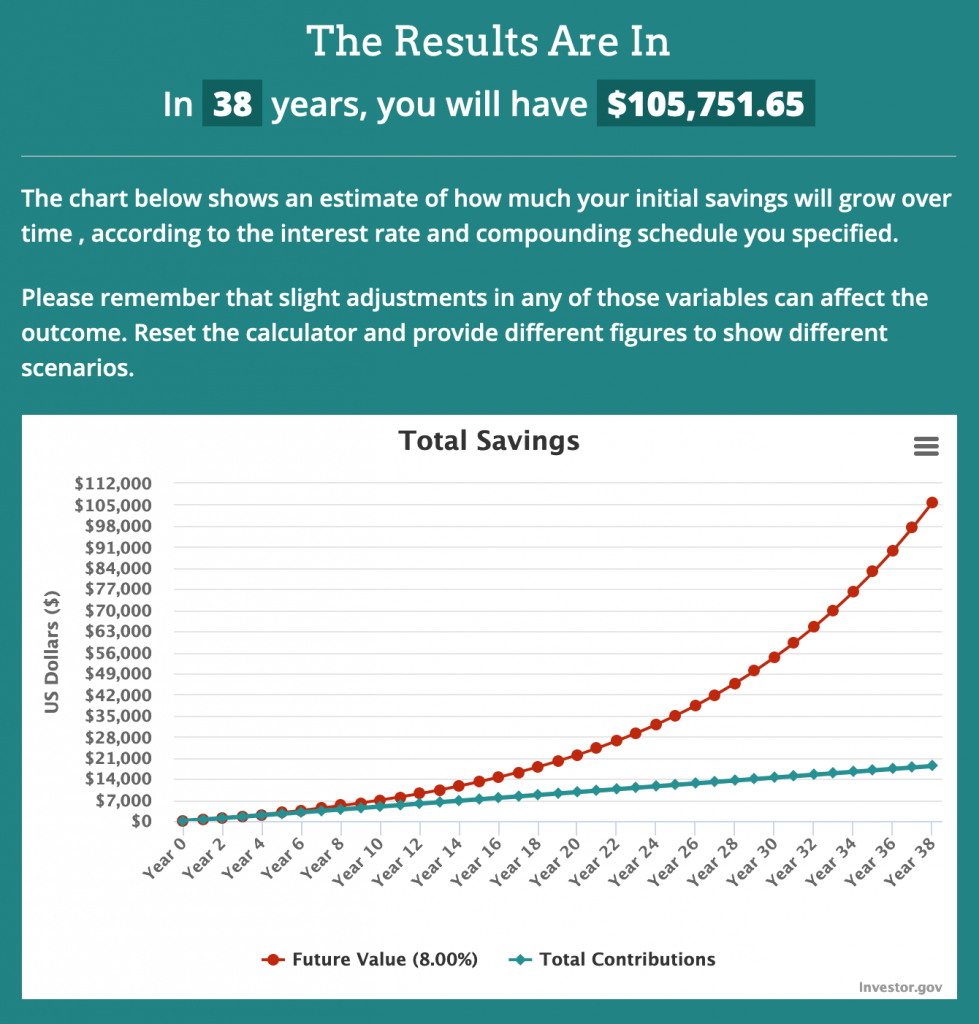

What about 2 books a month all you book worms out there? I know I typically read one book a month. So my wife and I collectively read 2 books a month. That’s $40 a month of savings from going to the library for our books.

Realize now that we have reached over $100,000 by the end of 38 years. Deciding to rent your books from the library isn’t going to give you all you need to retire, but this is a pretty impressive amount if you ask me. For those who can live off $40,000 a year, this represents 10.5% of your nest egg needed for financial independence.

Takeaway

The point of this post is not to convince you that saving money on books is going to give you the savings to become financially independent. But! This is one weapon in your arsenal that brings you one step closer to it!

The whole point of this website is to give you tons of different ideas on how to squeeze more savings out of your existing spending. For my wife and I, we had been burning well over $40 a month on books between the two of us. And it continues to astonish me how many different ways there are to save more money.

So, why not do the equivalent of flossing for longevity and start renting your books from the library. A lifetime of this habit change is one step closer to financial independence. Plus, it reduces your yearly budget and grows your nest egg getting you that much closer to more control over your life.

You can do this. Small changes each and every day. That’s all that’s required.

Pingback: Goodbye macOS, Hello Ubuntu! - Seth Lewandowski

Pingback: The 5 Lessons a Millionaire Taught Me - The Frugal Feline

Pingback: January 2022 Spending Review - The Frugal Feline