Diving head first into the Financial Independence community has taught me a lot about money. And most people will say, “Yeah, I’m not really interested in any of that Financial Independence Retire Early (FIRE) stuff so those principles don’t apply to me.” I’m sorry, you’re not interested in becoming financially independent? You’re not interested in ceasing having to answer to creditors, lenders, and employers? Alright, whatever. But the fact that as a culture we are so fixated on income as the be-all end-all score to keep track of is sad. It’s sad because income is just half the picture. It’s only half the calculation for our score. The scoreboard is not our income. The scoreboard is our income minus our expenses. As the old saying goes, “It’s not how much you make, it’s how much you keep.” How much do we keep?

Our Fixation On Income

Cashing your paycheck is not a win. Far too often we only care about income. Notice how in conversations with friends and family about money, the conversation always goes, “Yeah I got a raise this year.” Or, “I’m going to be studying _____ because the entry level salary is $_______.” And how often do we just assume people are crushing it because they’re raking in the big W-2 salary? They have the financed cars, houses, vacations. Fixating on income is like going fishing with a massive hole in the bottom of your fishing boat. Even if you’re slaying the fish and catching one on every cast, what if they are all just dropping out of the bottom of your boat and back into the ocean? It’s a dumb analogy. But it’s also a pretty accurate one.

We fail when we solely focus on income. And that’s because the scoreboard is not our income. It’s our income minus our expenses. The scoreboard shows what we keep. Not what we make.

The Other Half Of The Score – Expenses

Want an idea for a fairly awkward conversation with friends and family? Ask them, “How much did you make last year?” Why is this so awkward? It’s because most of us attribute our personal worth with our market worth (i.e. our income). Oh, you make $65,000 a year? Well, I make $80,000 a year and now I feel validated and confident in myself. You might laugh, but this is real. The reason these things are awkward to talk about is because we identify too much with our income.

Want an idea for a better question that levels the playing field a little bit? Ask your friends and family, “How much did you keep last year as a percentage of your income?” Yeah, I know it’s a little more wordy. But it’s also a little more valuable of a question. What we keep is a more accurate reflection of whether we are winning in the game of finances or not. It’s like playing a sport and only caring about how many points you’re scoring. What happens when you don’t play defense and only care about offense? You will still lose the game.

Need help on defense? I have an entire half of my site dedicated to it.

The Real Scoreboard

When we find a way to start living on only a small fraction of what we make, we unlock incredible power and freedom in our lives. We also drastically improve our ability to become financial independent.

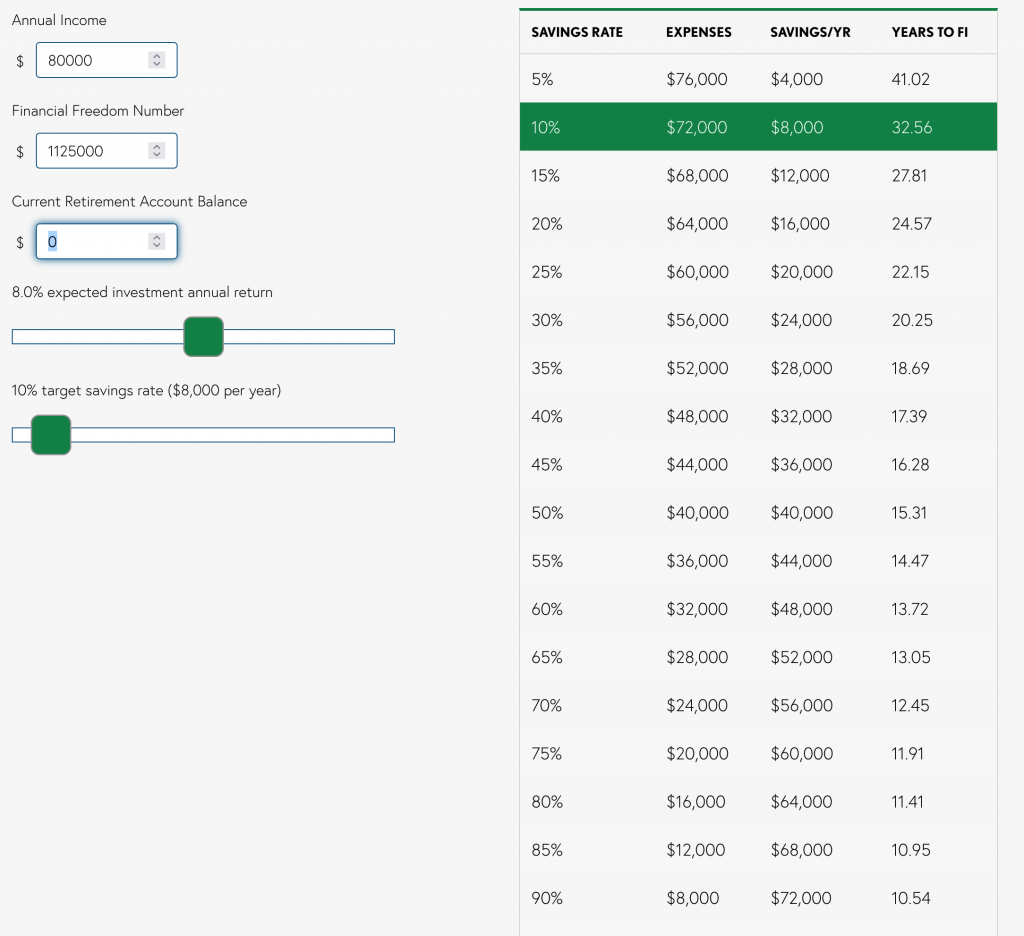

This visual below comes from Grant Sabatier’s Millenial Money website which I recommend checking out. This is the retirement/financial independence timeline for someone making $80k a year, spending $72k a year, and planning on retiring on $45k a year. The financial freedom number is (Annual Cost of Living x 25) = ($45,000 x 25 = $1,125,000).

As you can see, at a 10% savings rate (widely recommended in our culture), you’re looking at 32.5 years of working until you can retire and maintain your lifestyle. But notice this, deciding to save an extra 5% will knock off 5 years from your working career! Or, you can figure out how to live on only 65% of what you make and save the other 45% and cut your working career in half. That’s the crazy power of preventing lifestyle creep and living on less than you make.

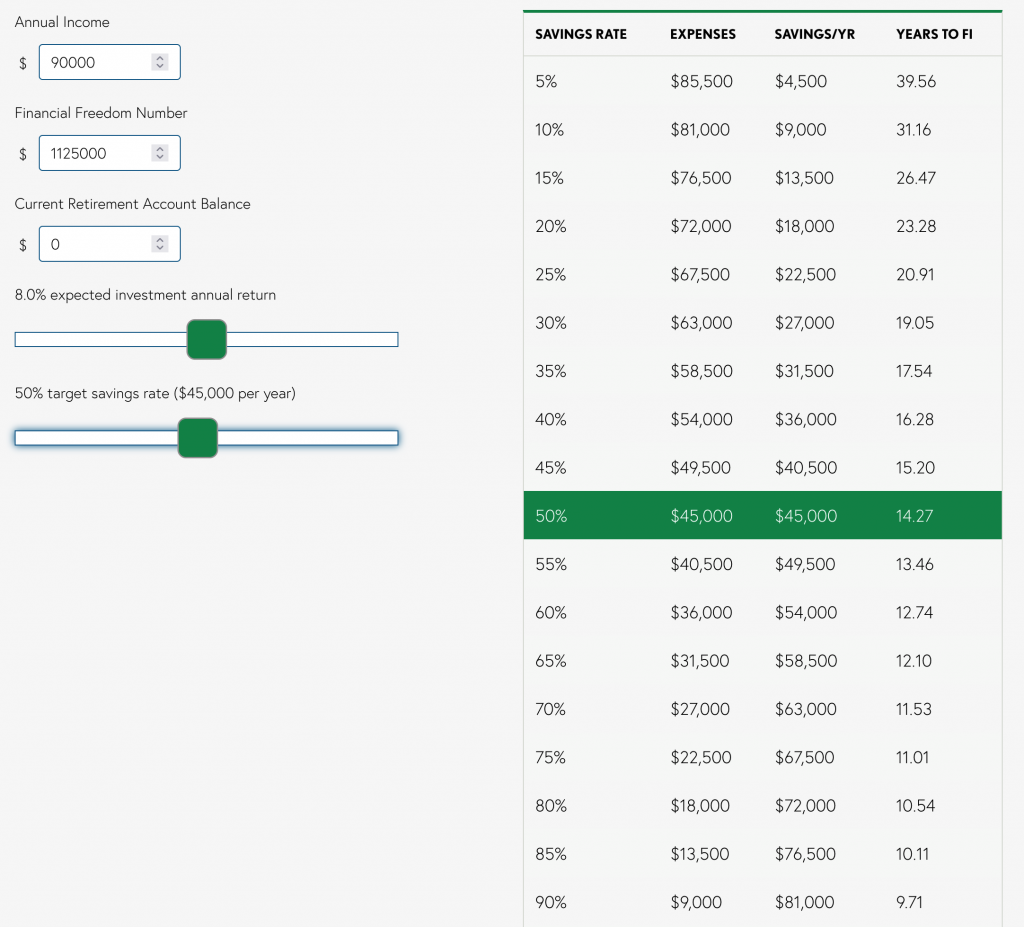

Now remember, we are only really playing with half the scoreboard here – our expenses (defense). What if we decide to start side hustling on the weekend and make an extra 10k a year while keeping our cost of living constant at what we plan to retire with – $45k / year?

Boom. Now we are only having to work for 14.27 years before we can just retire and maintain our living standard. This might all sound crazy, but there are people who’ve followed this roadmap and are retiring in their 30’s based on this simple table.

Defense Wins Championships

For anyone out there who played sports growing up, you might have heard the expression, “Defense wins championships.” I spent my entire 20’s thinking that the key to unlock freedom in my life was going to be more money. More income. It wasn’t until my late 20’s that I started to understand the critical role that lifestyle creep and cost of living play in our personal financial picture. We are a culture of offense. We praise and revere the teams that put wild points up on the board regardless of how much they let the other team score.

So let me ask you this: Are you a team that puts up 100 points on the board only to win the game by 2? Or are you the team that spends time on both offense and defense and wins games by 20 or 30 points?

It’s a stupid sports analogy, I’ll admit. But you’re not going to see any teams win world cups, super bowls, gold balls who aren’t spectacular on defense. For financial independence and retirement, the scoreboard is not our income, it’s also our expenses. And we win when we maximize that spread between the two.

Pingback: November 2021 Spending Review - The Frugal Feline