I’m embarrassed to admit that my wife and I spent $1,300 on groceries and alcohol in October. No, that is not a typo. We spent more than most people’s rent on putting food and beverage in our stomachs. Groceries is one of the naughty 3. And it’s one of the areas that we’ve found the greatest opportunity to save money, obviously. Now, let’s talk about how to save money on groceries, because Lord knows we can speak to it.

$1,300 for 2 People

It was ironic that the month that my wife and I decided to start taking our spending seriously was the month that we spent $1,300 on food and alcohol. I’m honestly embarrassed to admit this, but I think that this situation is much more common than we think. The truth is, unless we’re literally tracking every expense, we have no idea where our money goes each month. It comes in, it goes out, then we start all over again on the 1st.

This was the case for me, and I’m sure it might be the case for you. Since I entered the workforce in 2014, my income has grown steadily. Not exponentially by any means, but steadily. Yet, I have a laughable amount of savings stored up. More ironic, is that I grew up in a household of two entrepreneurs as parents and graduated with my degree in Finance from the University of Oklahoma. What a joke right!

The reason I care so much about this is because if there was ever a person to be a natural at saving money, it should be me. Yet, I’ve fallen victim to the same thing most people do. My spending tracking my income leaving nothing left to save at the end of each month. And it’s worth noting here the dismal amount of wealth that survives the second generation. This just means that either the rich don’t teach money lessons to their children. Or more likely, knowledge is pointless without application which is definitely the issue for me in this case.

It’s critical that you understand where I’m coming from and the point I’m trying to make. It’s up to us to decide that personal finance is important enough to take seriously and do. You can have all the knowledge in the world but if you don’t take action, you’ll end up not having enough money to pay for your kids college, retire at 65, or take fun vacations along the course of your life.

How To Save Money On Groceries

Saving money on groceries is one of the biggest ways we can free up money for investment each month. As I mentioned, my wife and I spent $1,300 on groceries and alcohol this past October and by following a few easy steps, we’ve cut it down to $600 last month. Now, for many of you, you’re laughing at me because spending $600 a month on groceries is absurdly high. And I get it! I agree with you! Nonetheless, we are excited about the track we are on and I want to share some tips on getting that grocery bill down.

1. Care

As crazy as it sounds, the simple decision to care about how much you are spending at the grocery store is enough to immediately start saving money. I can’t even explain this one logically. But what I can say is, when we are mindful of things, we tend to do a better job managing them. My wife almost started to make a game out of this. Each time she went to the grocery store, she would come back and brag about how little she spent. Caring about saving money on groceries will actually make you find ways to save. It doesn’t make sense, but it works.

2. Meal Plan

Each week, my wife sits down and makes a plan for the meals we are going to make each week. We always skip breakfast, so that’s not a factor. (Consider for a moment now how insane that $1,300 is now that you know we only eat 2 meals a day.) Lunch is always a salad made at home with fresh greens, vegetables, and seeds. But dinner is where we really have started to save money. By planning dinners ahead of time, we always batch cook our dinner to make sure we have enough leftovers for tomorrows dinner also. I personally love this because it drastically cuts down on the amount of time we are spending cooking. There is really nothing better than throwing a pot on the stove and having a warm meal ready in 10 mins.

You will, without question, save money by planning ahead. We waste money by shopping hungry. Or worse, deciding to eat out because we don’t have anything to cook for dinner. Plan ahead and get control of your food spending.

3. Have a Strategy

My wife and I purchase as much as we can from Costco on our 1x per month trip there. We buy our organic brown rice, organic coconut milk, organic red wine, organic cashews, beer, seeds, organic quinoa, organic split peas, grass fed beef jerky, organic coffee, chocolate chips, organic olive oil, and organic coconut oil all from Costco which typically saves us at least 50% as opposed to purchasing those items from Sprouts. These are just some of the many things we try to buy from Costco. And we typically find that the per unit cost is about 50% of that at other grocery stores. Next, we shop at Sprouts and try to find good deals. Again, the key is having a plan and strategy for saving money.

You don’t have to sacrifice quality to save money on groceries. My wife and I buy organic as much as possible and we still found a way to save $700 on groceries last month without starving to death or eating Ramen noodles every night.

Buying in bulk is probably the single biggest opportunity to save big money on groceries over the long run. And I know it’s cute and fun to shop at Whole Foods. But it should probably be a last resort for things you can’t find at Costco or Sprouts/Walmart/Safeway/Fry’s.

4. Start Liking Leftovers

We all know that you can save money by buying in bulk. But have you considered that you can also save money on groceries by cooking in bulk? Double every recipe and you’ll end up with plenty of leftovers which make eating both lunch and dinner in easier. And don’t even get me started on how much money there is to save on packing your lunch!

What Are the Savings on Groceries Worth?

It’s hard to generalize here, so I’m going to use myself as an example. I’ve been tracking our spending for the last 6 months. So I know that we’ve been spending on average $1,148 on groceries for 2 people who never eat breakfast. Our goal is to get that down to the $450 range. But last month we only got it down to $600.

Future Value of $600 Monthly Grocery Budget

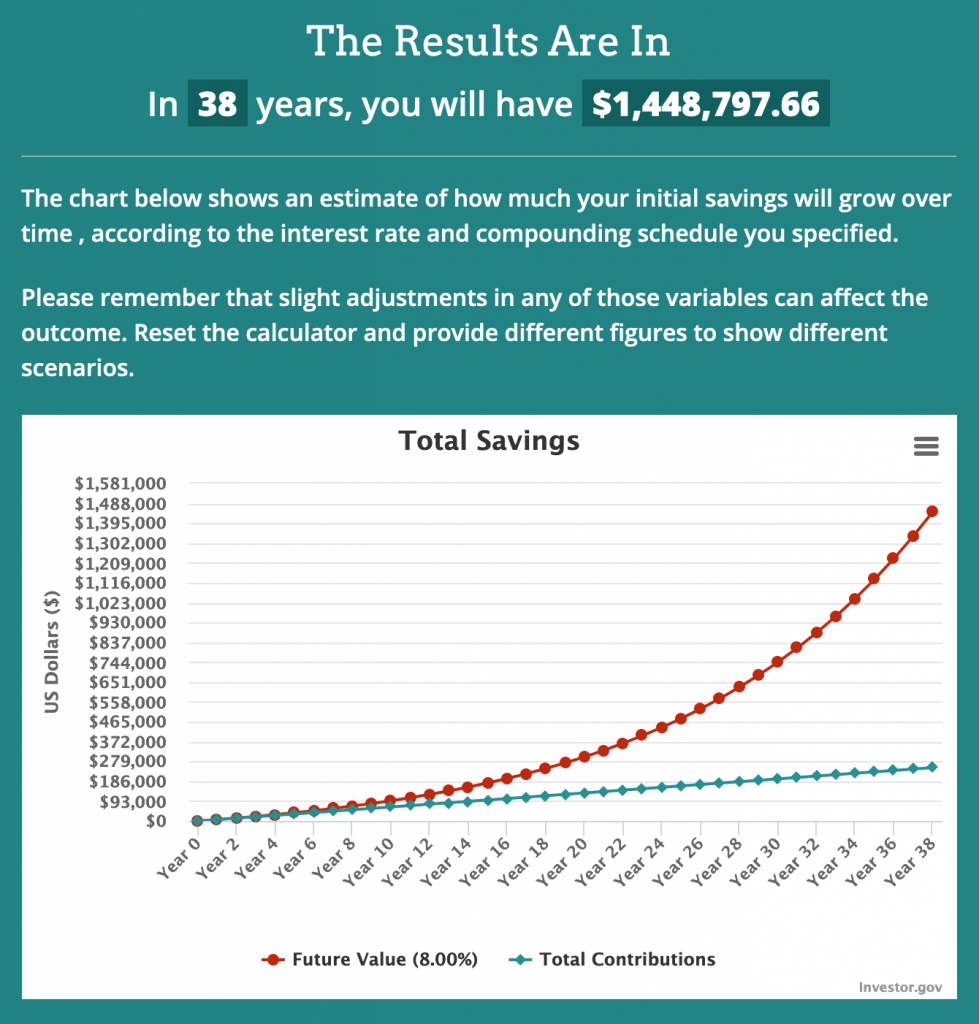

Say, worst case scenario we are able to maintain that $600 monthly grocery and alcohol spend. If we were to take the savings and invest it over the course of 38 years, I’d bet we’d have a pretty sizable chunk of money.

This means that, if my wife and I can maintain this spending on Groceries and invest the difference each month, in 38 years we’d have over $1.4 Million. Now, using the 4% withdrawal assumption, that means we could retire and have an annual budget of $57,951 each year. And believe me, there are a lot of people who would love to retire on this amount of annual income.

Future Value of $450 Monthly Grocery Budget

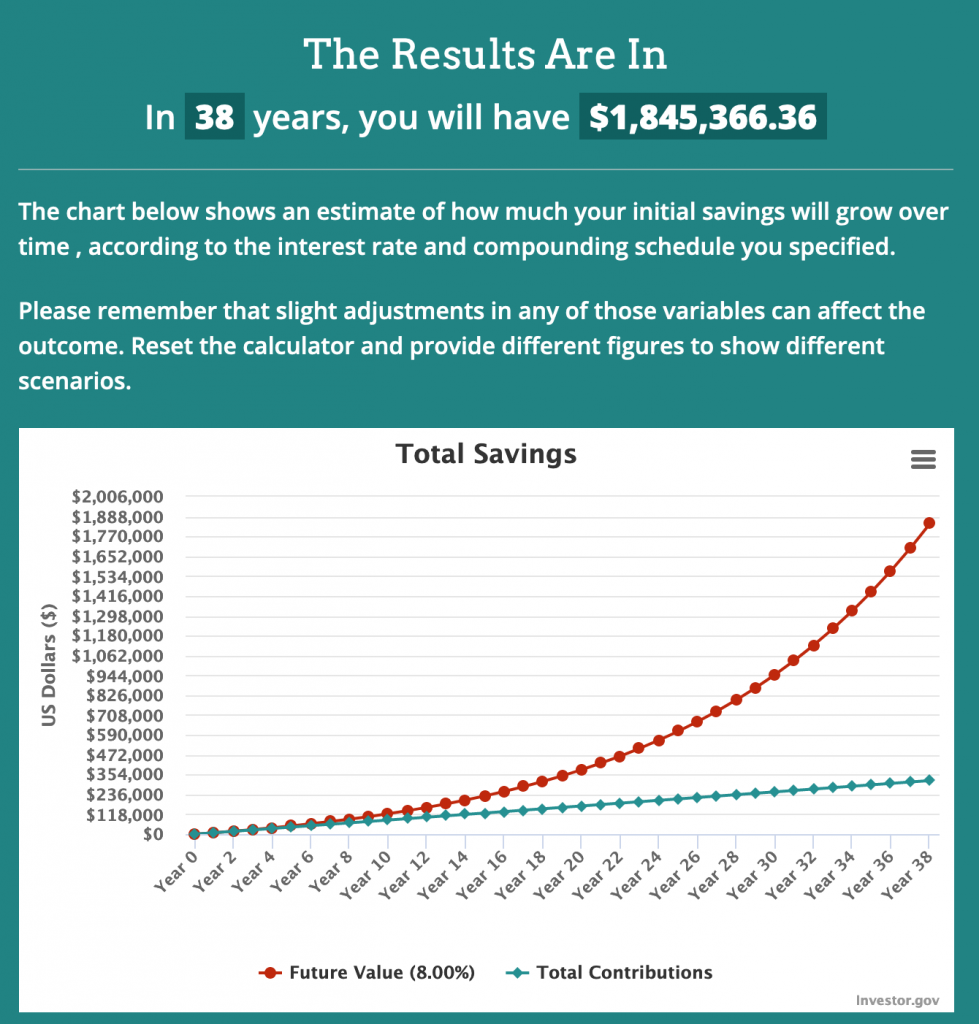

To be totally honest, I’d be surprised if my wife and I could get our budget below $450 and sustain it over the long term. So this feels like a safe estimate. Let’s look at the 38 year future value of investing the savings leftover after reducing our spending to $450 on groceries and alcohol each month.

Alright! Now we are really cooking! $1.8 Million at retirement would allow my wife and I to live off $73,814 each year for the rest of our lives. That’s pretty crazy right there.

Saving Money on Groceries – To Be Continued

We are only getting started trying to reduce our monthly grocery and alcohol spending so I don’t know where we will end up quite yet. But in the first month of trying we reduced our spending by 47%. And this was during the month of Thanksgiving!

So this topic is really open ended but I thought it was worth sharing the following:

- If you aren’t tracking your spending, you could be spending just as much as we were on our groceries. That’s a lot of money on food and a massive opportunity for savings.

- If you are tracking your spending, there is hope. Groceries is one of the biggest bangs for your buck as far as potential for saving money each month. This is one that’s worth taking seriously and going after hard.

- You can go all out, but you don’t have to. My wife and I still eat mostly organic meals. And honestly, aside from caring, we really didn’t even notice a difference in our meal quantity or quality last month.

Like I said, our ultimate goal right now is to get to $450 a month which would be down 60% from our last 6 months average spending. If we can do that, then we will have a significant amount of money freed up to start buying assets.

Pingback: The Naughty 3 Expenses - The Frugal Feline

Pingback: How to Track Expenses - The Frugal Feline

Pingback: The 3 Biggest Wealth Destroyers - The Frugal Feline