My wife and I figured out pretty quickly into our FI journey that if we were going to have any success, it would have to be a team effort. While I was excited about our ability to continue growing our income, I started to realize that was only half the picture. And my wife had the most ability to influence the defensive side of the equation since she did most of the shopping. And if you’re already deep into the FI community, you already know that the scoreboard is not your income. The scoreboard is our income minus our expenses. It’s our savings rate. Hence the weekly spending review was born.

Now, to be totally honest, I’ve been hesitant to be transparent about any of our expense details up to this point. But the more I wade into this culture and lifestyle, the more I realize that the taboo nature of personal finance does more harm than good. And I’d be a hypocrite to recommend starting to talk about this stuff more if I wasn’t willing to do that myself. So, without further ado, here’s how we did on our spending for November, 2021!

November 2021 Spending

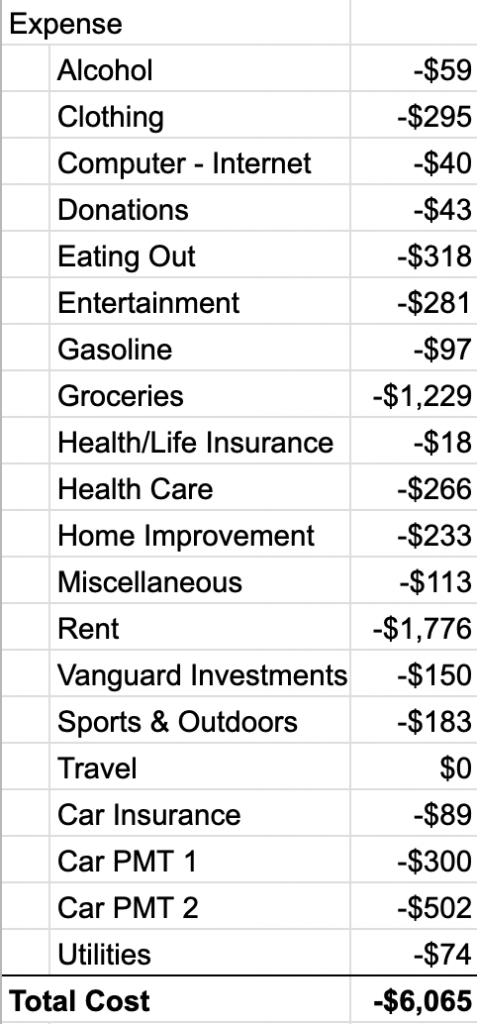

We were THRILLED about our November spending. While a lot of people will come across this and think, “Holy crap, they spend $3,200 a month on two people?!” It’s important to know where we came from. So, to go all the way back to the first month that we ever decided to track our spending, we have to go back to April of 2020.

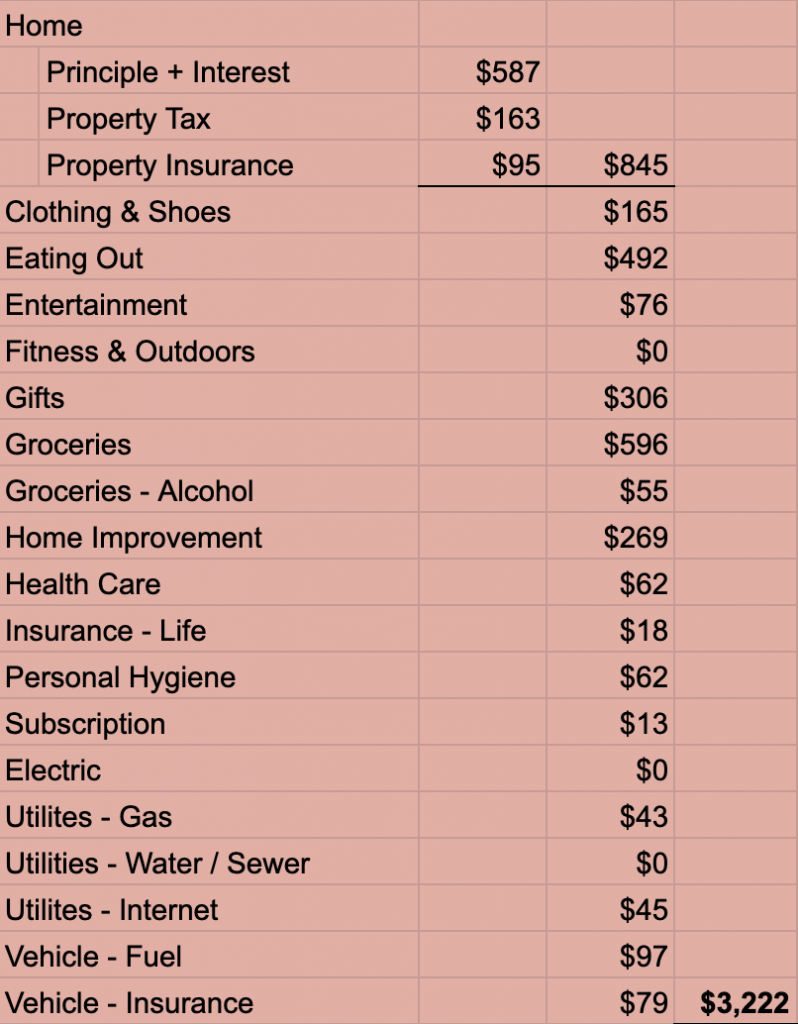

April 2020 Spending

Now as you can see, we clearly have come a long way from our humble beginnings of figuring out how to spend over 6k on two people’s lifestyle. What’s worth noting here is we were just as susceptible to lifestyle inflation as anyone else. In fact, this month, we managed only to save a meager $150 in our vanguard brokerage account. And that 2.5% savings rate isn’t going to get you to FI anytime soon. So, with the exception of that $150 saved, it was about 6k in, and 6k out. With basically nothing to show for it at the end of the month.

We somehow spent $1,200 on groceries AND $300 on eating out. And our rent was much higher than our mortgage payment is now. And at this point, we still owned 2 cars and were making payments on both of them.

25% of what we made in April was spent on food. How insane is that? And our housing was 30% of our take home pay. Tack on 13% going to car payments! So, our food, housing, and car payments made up 68% of our entire take home pay!

Oh my gosh. It’s crazy to look back at this train wreck of a monthly spend. But like I said, this is helpful context to explain why we would consider our November to be a success!

November 2021 Spending

Typically the first few things I’ll look at are our variable expenses (I’ve been wanting to split this section into a Fixed/Variable, but haven’t got around to it yet). Specifically, the categories that get out of control for us are Groceries, Eating Out, Gifts (not a humble brag), and Home Improvement.

Eating Out clocked in a little higher than we’d like at almost $500. Especially when you consider that we also managed to spend $600 on Groceries. We all know that spending $1,100 on food for 2 people just doesn’t make sense.

Gifts is another category we’ve been trying to get under control. This one somehow always finds a way into the range of $300-$500 because there is always a birthday, baby shower, wedding. And not that there’s anything wrong with giving gifts, but dang, it’s just a lot of money!

What you may or may not have noticed is some big changes we’ve made since our humble beginnings in April of 2020. Namely, we ditched the 2nd car and used the proceeds to pay off the rest of the debt on BOTH cars. #NoCarPayment! And you’d be surprised how amazing it feels not to have car payments each month! Also, our housing expense went from $1,775 to $845. Those two changes alone freed up an extra $1,732 in our monthly budget!

I could honestly talk about this all day, but to bring this full circle, lately we actively try to manage our Groceries, Eating Out, Gifts, and Home Improvement. Since it’s winter, we are doing less around the house or our Home Improvement spending might be anywhere between $200-$2,000. But all in all, we were very happy with this month’s spending and it allowed us to put a ton of money into our retirement accounts.

Biggest Changes In 2021

I would say we are still working hard to get our spending under control. While we’ve come a long way, there is still room to improve our cost of living, especially for only 2 people. Some of the major differences aside from big changes like moving out of our pricey rental and selling one of our two cars, is our behavior with food. We are finding less satisfaction in eating out these days. We are noticing that prices are going up at some of our favorite places to eat and honestly the quality of service is going down. Both of those are having a big impact on our enjoyment of spending our hard earned cash on a 1.5h experience that we have nothing to show for 24 hours later.

So we eat out less, we cook more, we shop less to stop putting ourselves in positions to create wants. Notice how you forget you “need” things until you go spend a few hours at a shopping mall? Maybe that’s just us?

We have made some major changes to our lifestyle and behavior that’s allowed us to drop our spending rate down to 59% on average each month. That’s a heck of an improvement from 97.5%, but still leaves a lot to be desired. November, we were proud to get our spending down to 32% of our income which unlocks some serious firepower to put money towards pretax retirement accounts. We still have a long way to go, but some of these changes take time.

Looking Ahead to December

If our December spending can look anything like our November spending, I will be thrilled! We plan to take some of our savings and extra money in checking accounts and try to max out our only traditional 401k (Mrs. Frugal Feline doesn’t have a job with a 401k). We have a ski trip coming up at the end of the month so we will try to take it easy on eating out to be able to do that while on vacation. Otherwise, it’s business as usual! Leaves are falling. It’s getting colder out. I’m excited to share our December spending and do a full post on our 2021 annual spending which will paint a much better picture of our slow but steady improvement over the course of the year.