Woah, what a crazy year. As I’ve mentioned in my post on my financial mindset heading into 2022, we feel like we freaking crushed it in 2021. It was the first year our good habits and preparedness met the opportunity of a new higher paying job in a new lower cost of living city. 2021 was big. But unfortunately, we didn’t exactly end on the brightest note spending wise. Now, enough pleasantries, let’s get into our December 2021 spending review and show the world our dirty little secrets.

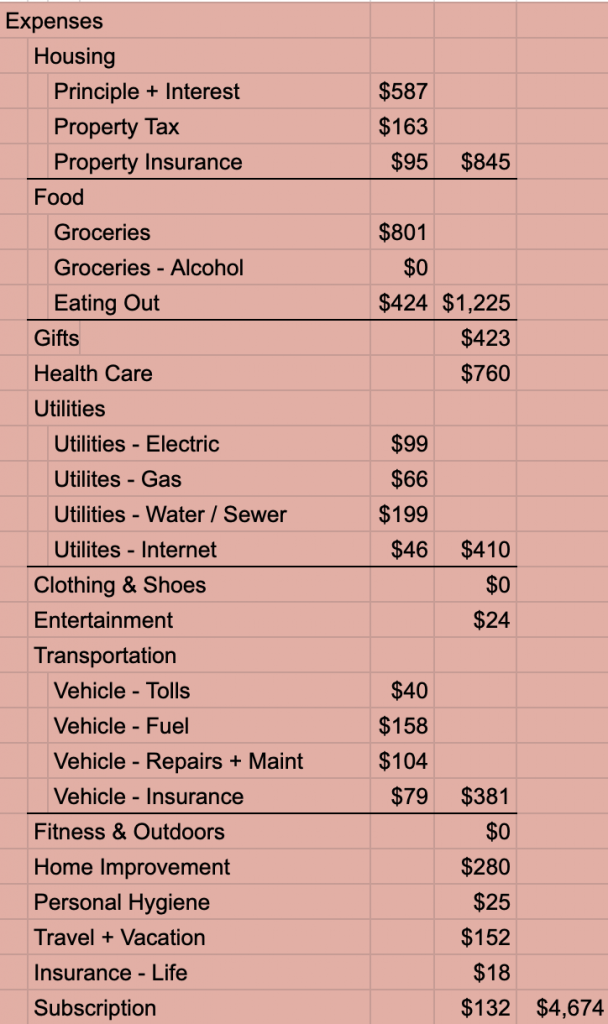

December Expenses

December was not terrible, but definitely not great. We spent $4,674 which was not our highest ($7,154 in May) and definitely not our lowest ($3,306 in November). I updated our spreadsheet a little bit because I wanted to play around with visualizations like pie charts and wanted major categories like housing, food, transportation to be one chunk and not separated out into individual pieces of the pie.

Housing

This year, I requested that our escrow account be closed. I wanted to put our insurance on our credit card for the points and wanted to stop prepaying our property tax bill. Bankrate has a good article outlining the pros and cons of using an escrow account. Those aren’t exactly massive wins, but it also provides more transparency into what will fall off when the mortgage gets burned (and what won’t). I think we have a tendency to overestimate the cash flow freedom of a payed off home, when in reality, for a small mortgage like mine, I’ll still be paying $258 a month to own a home. And to be honest, it drove me crazy how the mortgage holder kept changing the escrow amount. It was just annoying, confusing, and felt out of my control. Now it’s totally in my control and feels great.

Food

Our food is another face palm here. Freaking $1,225 on food for two people who eat most meals at home. It just doesn’t make sense. It feels impossible to keep our eating expense low. But whatever, we are considering going on the envelop system to get our groceries/eating out under control. This is one of those categories that is very difficult for us to keep low.

Gifts

Our gifts is always high. But this is December so even if we didn’t have a bunch of showers or birthdays, as we normally do, this would still be high. Mrs. Frugal Feline insists that it’s a necessary part of being a good human being and having friends. I’m not totally convinced… (Just kidding.) But seriously, every month we spend anywhere between $400 and $600 on gifts and it drives me insane.

Health Care

Health care is also a little high this month. We typically see holistic docs who don’t usually take insurance so we are usually paying out of pocket the full amount for supplements, medications, and visits. This isn’t a big deal though. Plus we finally got on a high deductible health plan so we can now save our receipts and reimburse ourselves in the future (more on that strategy in a future post). Our health is our wealth and I don’t mind paying cash for the care we want from who we want.

Utilities

Our utilities are high. That water/sewer represents a delayed payment from last month so it’s not totally accurate. We also have terrible windows from the 70’s that are getting replaced next month. That will help our gas/electric massively. This is a category that I think we will get down over the course of this coming year. Excited to see where we end up here in a few months.

Transportation

You’ll notice that despite having a paid off car, we still realize about $380 bucks for a 4 day commute 7 miles one way. It’s expensive to own a car.. It’s true. And I don’t even spread out the cost of registration each month so this number would be higher. We are a 1 car household and have been doing that for just about a full year now. And no, we don’t live in NYC or SF or somewhere ultra walk-able with tons of municipal transportation options. We live in the south, y’all where garages are storage units and the $60,000 cars are parked outside in the sun, hail, snow, and naders (slang for tornadoes).

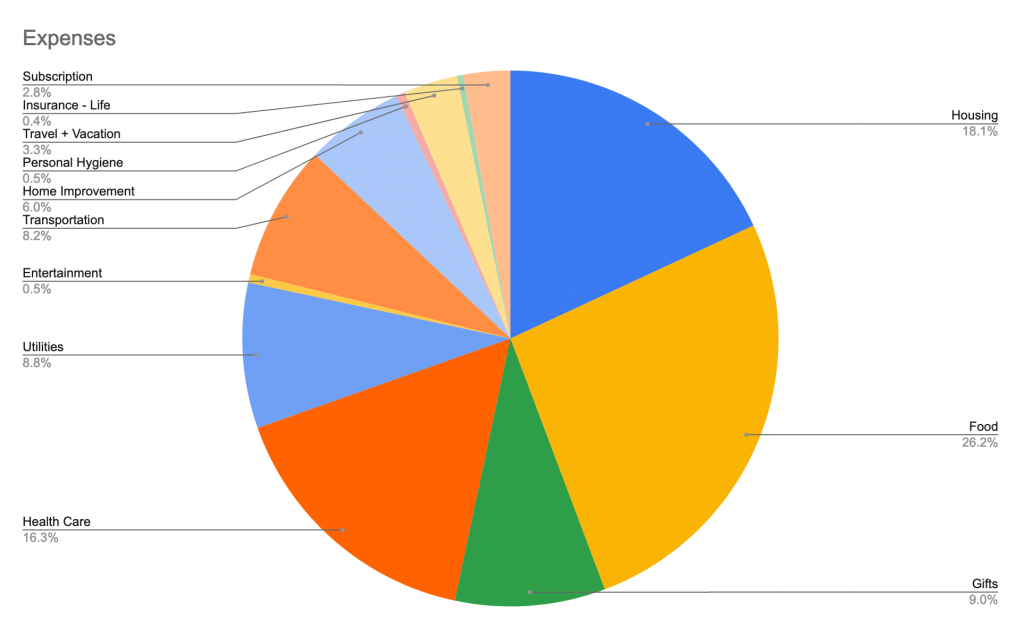

The Pie Chart

This is the main reason I changed up the expense breakdowns. I wanted to visualize the portion of our total expenses. I don’t know yet what I’m looking to glean from this pie chart, but it’s just cool to see the portion of the whole that each category represents. This is what happens when Mr. Frugal Feline gets bored at work and starts obsessing over the budget again.

Looking Forward to January

January we will be vacationing for most of the month. We are traveling to ski then traveling to Arizona to enjoy the warm weather. Our normal expenses will definitely be higher in January, but I think our Gifts and Health Care will drop quite a bit which will help. At this point, the only expenses that still give me heart burn are gifts and eating out. It’s not that I’m greedy or anything, it just seems crazy that every month there is $400 – $600 worth of gifts that we need to give. Especially in light of a total spend some months of $3,300. Anyway, January will be a little high. But it’s a necessary evil to keep our sanity and give us the gumption to crush our finances in 2022.

A Call to Comment

What surprises you about our spending in December? Do you find your December spending higher or lower than the rest of the year? What areas do you think we have opportunity to cut?