Dang, the months really start to fly by don’t they? As of this writing, it’s March 9th and it feels like Christmas was last month. Life is good. It’s cold, but getting warmer. Work is good. Nothing really to note. Our spending is in control, but this month was a good example of the need for preparedness. Let’s jump into our February 2022 spending review!

Housing

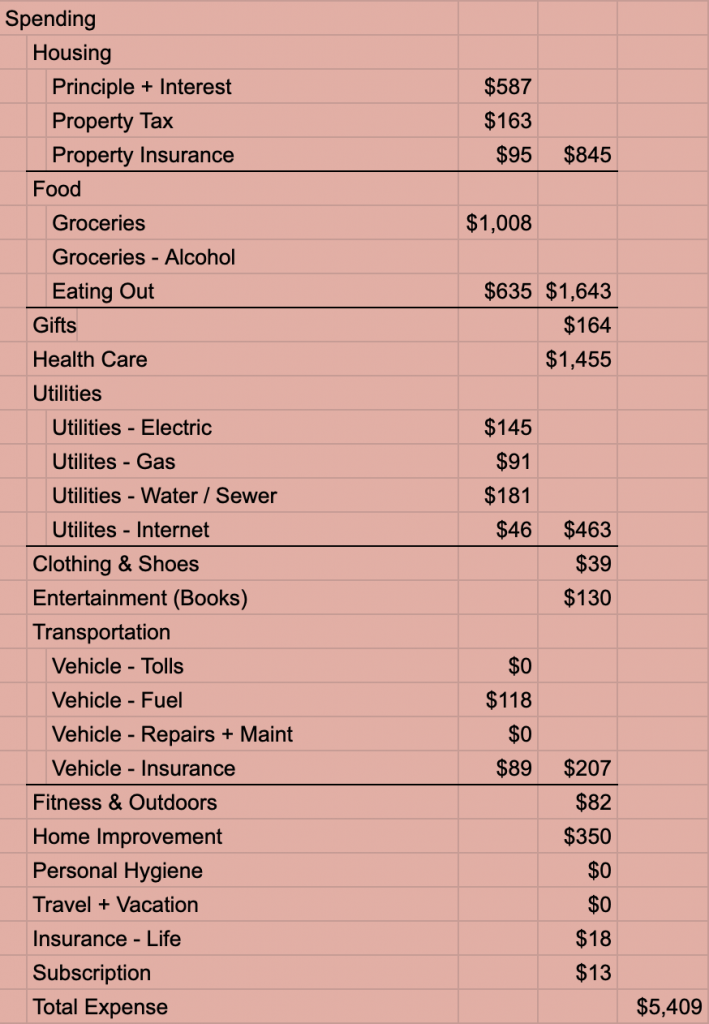

I’ll tell you this, I am grateful for owning a home every time we do the budget. That housing expense column feels like a win every month because we’ve gone from renting at $1,800 a month to owning at $845. Now, that required relocation away from the western US. And honestly, there are some months where we have to shell out some serious cash for home repairs. But at least it’s ours. And at least we can make the changes we want to.

Food

(facepalm)

Clearly you can see we’ve failed to itemize for alcohol. It’s not a ton of money, but it’s not zero either. I probably need to stop trying to track that because that’s just a little too obsessive.

As you can see, we went ham on groceries this month. Cracked into the 4 digits which is familiar territory for us. We try, but somehow even with eating mostly soups, getting quality ingredients just feels impossibly expensive.

The eating out I can deal with. We had some birthdays and some needed date nights. No complaints there. Still though, I’m having trouble getting used to spending almost a grand per person on food each month.

Health Care

They say when it rains, it pours. And this month, we poured cash all over our dentist’s wallets. Seriously, $1,500 this month on dental work. Ugh.

Utilities

I am 29 years old and have missed one payment in my life. It was a mortgage payment. I switched the account that I was making this payment from and it didn’t get correctly saved. I didn’t notice. I was late 45 days before I realized the problem.

Our utility providers don’t offer auto pay to customers that aren’t current. We kept being a few days late because by the time I got the email and went in to pay the bill, we were already late. So we got on this cycle of being late, not being able to set up auto pay because of it, and now, we are having to make deposits to get a safety balance in our utility accounts.

I can honestly say, I am embarrassed to admit this. This is all ultimately my fault. And that’s why our utility payments are so high – we are having to make cash reserve deposits because our accounts keep going late.

Transportation

I’ve started to plant the seed in my wife’s mind that we should buy my uncles Honda Ridgeline when he decides to upgrade. She did not like that idea. But I am a pretty resilient guy. So stay tuned.

Our transportation costs were shockingly low this month. I double checked and it’s correct. I have no idea how our fuel cost is so low. I think this is just a timing thing (Filled up on the last day of January and first day of March).

Home Improvement

We are the proud owners of a wood stove now so we needed to get some equipment to efficiently split wood and kindling down to usable sizes. This is most of that $350 on home improvement. It feels great. We love our stove. It’s very warm, incredibly efficient, and has a wonderful coziness when it’s frigid cold outside.

Mindset Going Into March

Aside from dropping $1,500 on dental work this month, I’m feeling pretty great about how we did. If you ignore that dental expense, we finished up at $3,909 which I am honestly thrilled about. Especially since the home improvement purchases are all long term use.

The market is tanking right now. I’m training myself to see this as a good thing. As the saying goes, “Be greedy when others are fearful, and fearful when others are greedy.” We have many things on autopilot with our investments. So it’s nice when the market isn’t soaring to record highs ever week. I see it as getting to go shopping on sale.

I’m feeling a little bit of burn out. I was honestly hoping for more traction with this blog by now. I’ve committed to do 2 articles a week for a year – a reasonable, but still demanding schedule. I’m balancing a lot right now but I care a lot about this.

March will be chill. We aren’t traveling. Aren’t doing a whole lot. I expect it to be another calm month on the expense front. I’d bet that home improvement will be higher as we have some things we are wanting to work on. But you’ll just have to stay tuned for it!