We could likely fill our entire lives with literature on building wealth. But there are a few books that seem to not only stand the test of time, but deliver pound for pound on bang for buck. The Richest Man in Babylon by George Clason is a wealth building book that is worth the read. But let’s be honest, most people don’t read books anymore, so I figured why not share my favorite 5 wealth lessons from the Richest Man in Babylon.

5 Wealth Lessons from The Richest Man in Babylon

Bansir is the central character of this book and he is frustrated. He’s pissed because he’s well into adulthood and works his butt off but his bank account is empty at the end of every month. I think we can all relate. I for sure have had months where my income has been very high and somehow or another every single dollar found it’s way out of my hands over the course of the month.

Bansir, after a conversation with his good friend Kobbi the musician, decides to go seek the advice of the wealthiest man in their city on how they can become wealthy. The following are 5 wealth lessons that I found most important from the Richest Man in Babylon.

1. If you have not acquired more than a bare existence in the years since youth, it is because you either have failed to learn the laws that govern building wealth or else you do not observe them.

This lesson is a dagger to my heart because it rings true for myself. I wasted the first 8 years of my working life building no real wealth not for lack of knowledge but for lack of observation of my knowledge. This is Arkad’s [ the Richest Man in Babylon ] first piece of advice and the core tennet of my favorite 5 wealth building lessons from the Richest Man in Babylon. If we are not where we want to be financially, it’s because we either haven’t learned the knowledge necessary, or we don’t practice it. It’s that simple. We must have both knowledge and action working in unison to achieve true wealth creation. It was as true over 8,000 years ago in Babylon as it is today in our modern culture.

2. I found the road to wealth when I decided that a part of all I earned was mine to keep.

Arkad learned the laws of building wealth from a money lender named Algamish. And this was one of the most pivotal ones. How often do we find ourselves with nothing left in our bank accounts at the end of every month? I know I sure have. Regardless of my increases in earnings, I always found a way to pay everyone but myself. I paid my landlord, grocer, restaurants, bars, auto lenders, etc. Until we decide that for every dollar we earn, a portion is ours and no one else’s, we will never build wealth. For until we do so, we are fools who pay everyone but ourselves. We labor for others.

3. He who takes advice about his savings from one who is inexperienced in such matters, shall pay with his savings for proving the falsity of their opinions.

What a sad place we find ourselves when after saving our money, we quickly lose it in stupid investments or business ventures. We have all been there. The truth is, we must be very careful who we take advice from and who we decide to put our money with. As much as we might like to believe that all financial advisors have our best interest in mind, that’s simply an ignorant belief. How often have we had family members or friends offer us financial advice or ‘stock tips’?

4. Arkad’s 7 Cures for a Lean Purse

In the book, the king of Babylon asks Arkad to teach his people who to build wealth so that the entire city may proper from the prosperity of its citizens. This points to a historical belief that in order for a city to proper financially, it’s citizens must prosper financially. This is why learning the laws of building wealth and practicing them is not evil, but good for society as a whole. Here are Arkad’s 7 Cures for a Lean Purse.

1. Start thy purse to fattening.

This one is as simple as ‘For each 10 coins that hit your bank account, spend only 9.’ And it really isn’t any more complicated than that. The real challenge is in observation of this lesson. (i.e. Doing it!)

2. Control thy expenditures.

Here’s a truth about men, according to Arkad. “What each of us calls our ‘necessary expenditures’ will always grow to equal our income unless we protest to the contrary.” This simply means, our spending will always match our income unless we decide otherwise. Again this was true 8,000 years ago and it’s true still today. I for one know this to be a fact based on my own experience. What changed the game for me? Deciding I wasn’t too good, wealthy, or smart for a budget. A budget has given me power and control over my finances. And it will do the same for you.

3. Make thy gold multiply.

Here’s the rub. You can budget and save until the cows come home which is a heck of a lot better than being broke every month, but ole Mr. Inflation will come eat your lunch if you don’t do something productive with your savings. This is why I’ve dedicated an entire half of this website to buying assets. Saving money is only half the battle! We must be buying assets or else we miss out on the 8th wonder of the world – compound interest. The true measure of wealth is not a large bank account, but a bank account with a large stream of continuous income into that bank account. This is what happens when we buy assets that generate compound interest.

4. Guard thy treasure from loss.

One of the common themes of the most successful investors in history is their intolerance for loss. They do not and will not lose money. We lose money when we do one of two things – invest without knowledge or push our money to unreasonable rates of return. Don’t seek advice of men who’s income comes from giving you financial advice. Seek advice from men who have actually built real wealth on their own and who don’t make a living off you. And if it seems too good to be true (i.e. 100% rate of return on this new cryptocurrency) then it probably is.

5. Make thy dwelling a profitable investment.

“If a man sets aside 90% of his earnings upon which to live and enjoy life, then if any part of this 90% can be turned into a profitable investment, how much faster will his treasures grow?”

– Arkad

I’m not sure I can paraphrase much better than that. But let me point out this small detail that most of us would miss without careful consideration. There are a couple places in the book that point out an important caveat to this piece of advice.

“When the house is built, then you can pay the money lender with the same regularity as thou did pay the landlord. Because each payment will reduce thy indebtedness to the money lender, a few years will satisfy his loan.”

– Arkad

A few years. Not 30 years.

I can only venture to say this is a big difference between this advice 8,000 years ago and this advice applied to today. Most of us buy properties that we can’t really afford without spreading the cost out over the next 30 years.

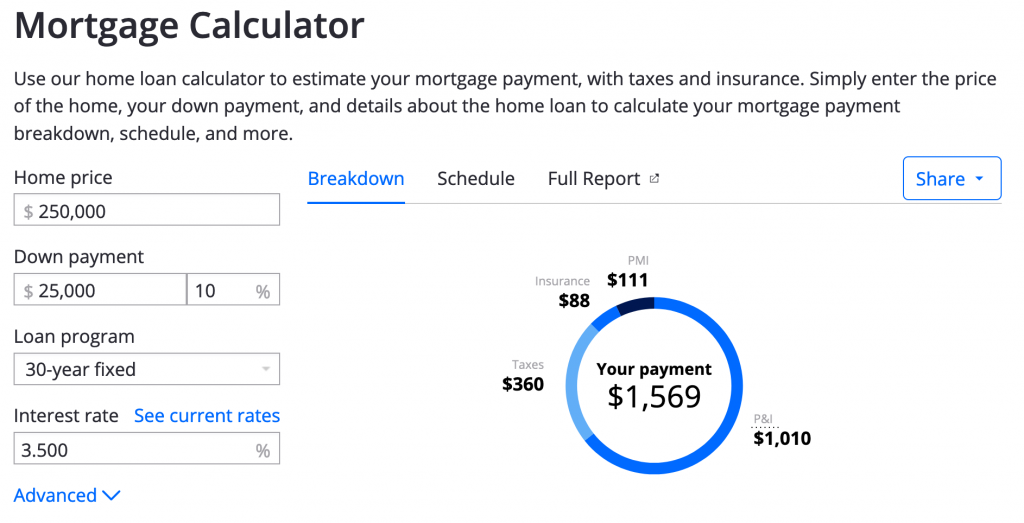

Say you buy a very reasonable $250,000 home and put 10% down. Well your payment is only $1,569 which is no more than you were spending on rent! What a deal!

Consider this – over the course of 30 years, you will have paid $564,840 for that $250,000 home. That’s $314,840 in interest that you’ll never get back.

So the real question is, “Is buying a home still a profitable investment if it takes you 30 years to pay it off?”

6. Insure a future income.

Arkad is saying two things here. First, he recommends buying life insurance if you have a family who depends on your income to live. Second, he recommends buying appreciating or income producing assets with your savings instead of stashing them underneath your mattress. The truth is, we will all get old and not be able to produce income some day. That is a fact. So it’s our job over the course of our lifetime to buy assets and insurance to protect against a certainty or a catastrophe. Whichever comes for us first.

7. Increase thy ability to earn.

Cultivate thy own powers, study and become wiser, become more skillful. To so act as to respect thyself.

Arkad

If you’re flipping burgers for 30 years at McDonalds, you can still get wealthy, but at a much slower pace and smaller scale in the long term. However, if you work your butt off. If you study and learn people management. If you get promoted a few times and eventually become the proprietor of your McDonalds, then the difference in your earnings and ability to build wealth will be a great multiple of the former burger flipping self.

There’s nothing wrong with flipping burgers. But there is something wrong with flipping burgers for 30 years. Because that would mean you’ve neglected to work hard enough to get promoted or learn the skills or knowledge necessary to increase your earnings in another job.

… I wonder what the Babylonians would have thought of a McDonalds within their city walls.

5. If a man be lucky, pitch him into the Euphrates and like as not he will swim out with a pearl in his hand.

What would a conversation about wealth be without addressing the topic of luck?

Well, according to Arkad, “Good luck waits to come to the man who accepts opportunity.” Meaning, luck may exist, but it cannot be depended upon or readily called into action. However, luck can be confused with opportunity to which a prepared man may be presented with at any given time.

My dad used to have a saying, “Opportunity favors the prepared.” And this saying very closely matches the entire takeaway for the chapter in this book on luck. Luck doesn’t really exist. And if it does exist, we can all at least agree that it can’t be summoned in any repeatable way. Opportunity, however, presents itself to all of us from time to time. The question is, will we be prepared to take action when opportunity comes?

Would you call a fisherman lucky who for years studied the habits of fish that with each changing wind he could cast his nets about them?

Arkad

Wealth is not built with luck. Look at winners of the lottery. Almost as if it were a law, all of their money is gone within a couple years. Wealth is built with preparation and taking action on opportunities of which we are all presented.

Final Thoughts

That’s it! Those are my favorite 5 wealth lessons from The Richest Man in Babylon. This is one of my all time favorite books on wealth and I can’t recommend it enough. Here’s a link to find it on amazon should you want to uncover more lessons on wealth building – trust me, there are plenty more in there. The book is literally $5. I can’t think of better investment of time or money.

And I will say, there’s one more theme layered throughout this book that’s worth mentioning.

Never be too good to work hard. Hard work is necessary for building wealth.

This is a theme thought the book as it was common to become a slave if you got into debt and couldn’t make your payments. [What a different world that would be today.] I think this is an important thing to keep in mind. Hard work compensates for many things. It compensates for less education, talent, opportunity, etc. We can’t always control where we grew up or how much money or opportunity is given to us. But we sure can control how hard we work to get ahead in life.

Pingback: How Much Do I Need to Retire? - The Frugal Feline

Pingback: How To Stay Motivated to Save Money - The Frugal Feline