As much as I’d like to think that we are all just looking for ways to stash as much cash as possible in our savings, I know not everyone rolls like that. And that’s cool! Whatever reason brings you to a post about saving an extra $50 bucks a month, I’m just glad you’re here and hope one of these ideas works for you. Now, I’m no frugality expert. I am simply a practitioner and student. I have gone from spending over $6,000 a month to just over $3,000 a month this past January. And while some wins were big! Most wins were small and cumulative. Little changes in behavior repeated over the course of a month can mean big changes in your budget. Anyway, let’s get to it. Here’s 5 ways to save $50 bucks a month!

1. Bring Your Lunch To Work 1 More Day A Week

If someone were to ask me:

What’s one behavior that I can change that will have the biggest impact on my personal finances?”

I would confidently respond, “Stop eating out.”

And I don’t mean literally never go out to eat anymore. But this truly is the single behavior change that will most likely have the biggest impact on your ability to free up money in your budget. It’s that need that never gets satisfied. It doesn’t matter if you go to a steakhouse and spend $140 on lunch or if you bring your leftovers from dinner last night to work. You will be hungry again in a few hours.

This category alone has freed up anywhere between $400 and $600 a month for us and that money is now fully funding one of our Roth IRA accounts each year.

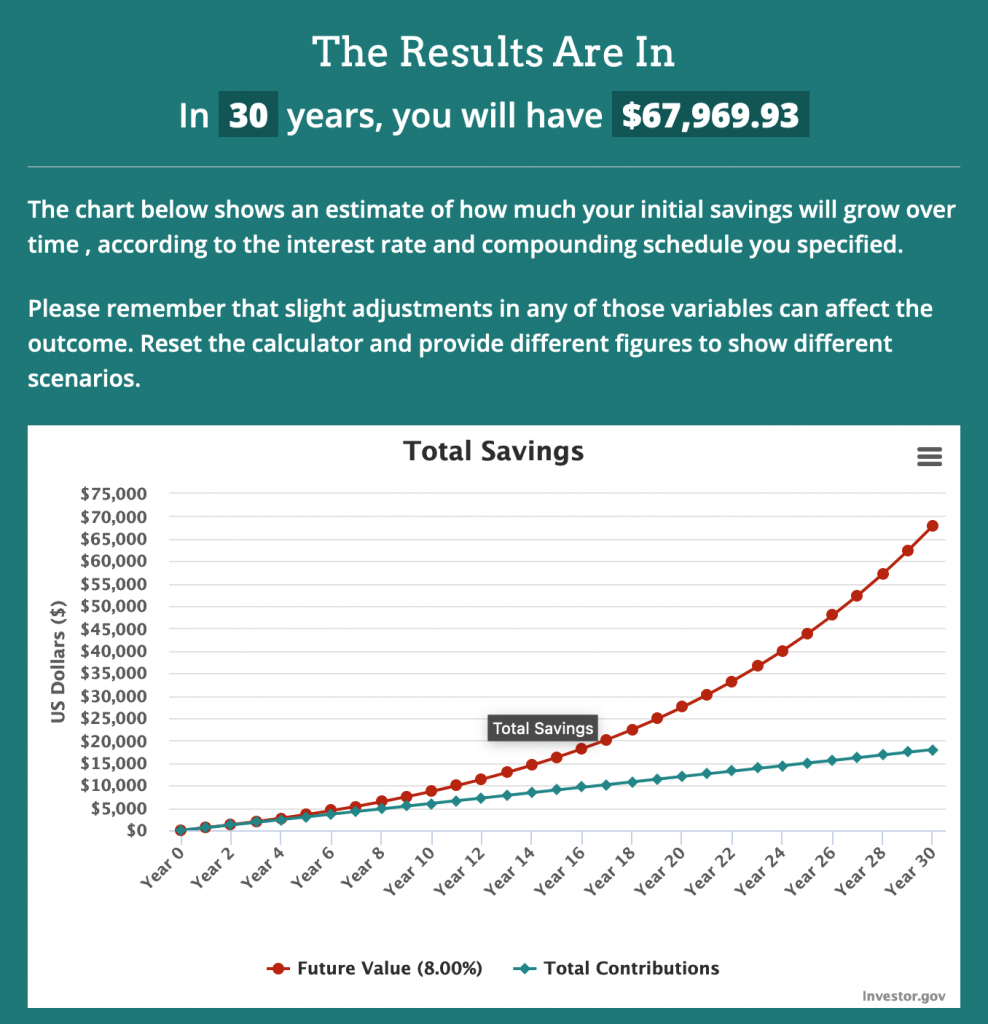

But again, what’s one way to save $50 bucks a month? Bring your lunch to work 1 more day a week. That will free up about $50 bucks a month in your budget and you know, blah blah blah, it’s like $68,000 in 30 years if you invest that money and don’t blow it on ice cream.

Yes, I know, I couldn’t help but show the compound interest future value chart here. But hey, at least it’s just one! This chart will apply to all 5 ways to save $50 bucks a month so there you go!

2. Shop Your Insurance

This is one of those things that we all need to do about once a year. I know, it’s annoying, but it’s also just the way it goes. We get offered low introductory rates (great discounts) on our insurance the first year or two with a provider, then slowly they raise our rates because they know the last thing we want to do is spend time changing insurance.

It’s called switching costs. You’ll notice them in the headache of switching internet providers. You’ll notice them in the reason you get a free phone for switching cell phone providers. And you’ll notice them in the reason you will get a 10% raise for switching to a new employer while your current employer will probably give you a measly 2% cost of living raise each year. One of the best ways to grow your income is to switch employers after a few years.

Our rates go up every year. That is a fact. So this is something that if you’re not doing, you’re leaving money on the table. We can shop our home insurance, car insurance, life insurance, phone insurance, pet insurance, plant insurance, etc.

I know it’s a pain in the butt. But put this on your calendar and spend 3 hours a year shopping your insurance. Even if it’s only a measly $50 bucks a month that’s $600 a year and a fully funded IRA.

3. Get Creative with Dates

What do you think of when you think of a date? Fancy dinner and a movie, right? Many women (Not all, I will admit) would be over the moon about a more creative, non traditional date. Think – going for a drive to a special place from your childhood and telling your spouse the story then going to a fun dinner nearby.

And if you’re needing help with ideas, this book called The Adventure Challenge Couples Edition is so helpful with coming up with inexpensive fun dates that you can go on. It pays to be creative. To be fair, the cost of the book is about $50 bucks, so maybe the savings starts on Month 2?

We’ve done a few dates out of this book and it’s a lot of fun. It gives you that kick in the pants to get out of your normal routine and go do something different together. Heck, even if you get a new idea and skip one night at the moves once a month, there’s your $50 bucks right there. Sorry AMC.

4. Stop Using DoorDash and Instacart

(Facepalm) It never ceases to amaze me how my broke friends and family are the only ones I know that use these services. Seriously, with Instacart, every item you buy is marked up! Do you really think people are just excited to go shop for you for free? As the saying goes, if it seems to good to be true, it probably is. But I won’t get lost on that rant..

Without question, this is an easy way to save at least $50 bucks a month. And honestly, removing the friction to get carry out (As if there were much friction in the first place) is probably not the best move for your wallet. Get in the car and go pick your food up. Or better yet, cook something at home.

5. Cook At Home

Look, I get it. I hate cooking too. But I hate being broke more than I hate cooking. So we batch cook dinners that last 3-4 days. That way, we are really only cooking dinner a few times a week, max. Get some salad fixings on hand in your fridge and lunch can be made in 5 minutes.

If you want to fatten up that wallet, give your money to your grocer once a week. Not your local Subway, Chipotle, and Taco Bell 6x a week.

Eating at home instead of eating out is the one thing you can do to have the biggest immediate impact on your finances. The cost of eating at home can be anywhere between 1/2 to 1/4 the cost of eating out. It takes some practice to get good, but just start with making your coffee and breakfast from home. That’s what we do. And I’ve written extensively on how you can make better coffee at home than most places in your city as well as how you can make a breakfast sandwich that will make you not want to go out for breakfast anymore.

Bonus: Go Prepaid On Your Wireless

I walk the talk folks – I do all of these things listed here. We never eat out for lunch during the work week. I just got done shopping all my insurance in December. I’m working on the date creativity, that one I’m still improving on. I don’t pay people to deliver my groceries or Taco Bueno. And we cook 19/20 meals at home.

But, because I love you – my wonderful reader, I feel so moved to share another little nugget of wisdom here. Last year, we switched to Mint Mobile on an annual prepaid plan and pay $240 per year per person for our cell service.

Now, I know what you’re thinking:

Oh, here’s another blogger making fat stacks peddling crap he doesn’t actually use. Thanks a lot!

And, I actually wish that were true! Well, the making fat stacks part.. I do use Mint Mobile, and I have tried to become an affiliate for them. But they will not have me. So, alas, I am left to simply share things I do to save money without being compensated in return. Anyway, I digress.

We used to pay $140 a month for our T-Mobile plans that included Netflix and a bunch of other crap we never used (like unlimited data). Now we pay in cash once a year for cell phone service year round that saves us literally $1,200 a year ($100 a month). Talk about a double whammy!

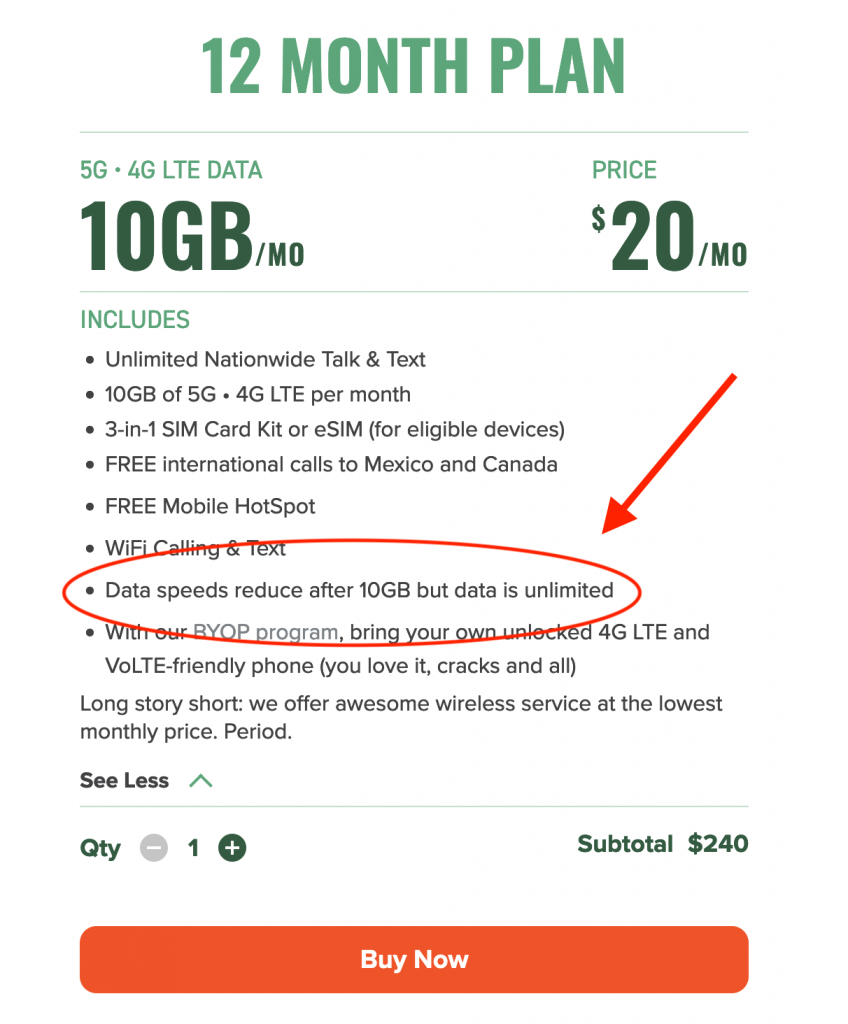

Worth noting that a common misconception here is people will say, “Oh, I need unlimited data. I can’t go a prepaid fixed data route. That won’t work for me.”

So I wanted to point out that at least for Mint Mobile, you’re paying for the amount of high speed data that you get each month. It’s still an unlimited plan.

We have been on this plan for over a year and neither of us have ever hit our data limit. Unless you have a habit of watching 1080p YouTube videos or Netflix movies while driving across the country, you can make this work. And it’s big savings.

Small Changes Repeated Over Time

Isn’t that just the secret? The media peddles the overnight success stories (And that’s what they are, stories, not facts) leading us to believe that these small changes over time won’t amount to anything. That’s a lie. I can promise you from experience that it’s possible to get in control of your finances. And you do it by small changes in behavior, done consistently over time.

Good small habits repeated over time create good big outcomes. Goes for finances, exercise, eating right, health, wealth, prosperity, relationships, education, work, etc.

Everyone always asks podcast interviewees, “What advice would you give your 20 year old self?”

For me, my advice would be: Stop looking for the overnight success and trust the small decisions and habits that inch you closer to the person you want to become, wealth and health you want to achieve, relationships you want to have, or job you want to have. Our small decisions do matter. Actually, they matter a whole lot. They are everything. We become our habits. They shape and mold us. The little things matter. Don’t believe the overnight lie.

Start Today

These are just 5 ways (well, 6 I guess) to save $50 bucks a month. There are hundreds of ways to save $50 bucks a month. Sure, big changes like selling a car, or moving to a different neighborhood, city, or state can free up hundreds or thousands in a single change. But not everyone has to make that kind of change to turn their finances around. Start tracking your spending if you’re not already and with knowledge of where your money is going, you have the power to change it. Godspeed!

A Call To Comment

Alright, I listed 5 but I know you probably have 10 that I didn’t think of or list here. What is a way that you found to save $50 bucks a month? I genuinely would love to know and put it into practice in my own life!