One of the best things that my wife and I have ever done for our personal finances is a weekly spending review. And it’s way more straightforward than you might think. So hang on tight because I’ll get right to the point and tell you exactly how to do a productive and efficient weekly spending review.

What is a weekly spending review?

A weekly spending review is just as it sounds – It’s a scheduled weekly meeting with your spouse where you go over your current progress on your monthly budget. As I’ve mentioned in another post, we use wave accounting software to track all of our income and spending via credit cards (insert hard slap on the wrist from Dave Ramsey here). I love wave. It’s simple. And once you get the hang of it, you can use it to do all of your small business or rental house accounting too. Anyway, so that’s a weekly spending review. And as with most things, it’s not complicated to do. The hard part is doing it, not the thing itself.

Why is a weekly spending review important?

Easy – because you get what you measure. Next question. No seriously, it was a good and fair question. But the answer really is that simple.

What should be tracked and reported on in a weekly spending review?

Here’s how I tackle it, but I’d encourage you to track whatever floats your boat. We are all capable of building wealth. In fact, I’ve built more wealth over the last 12 months than I have in most of my adult life. And my income is only slightly higher than it was in my first job out of college. You can do this. But it takes discipline.

1. Itemize Transactions

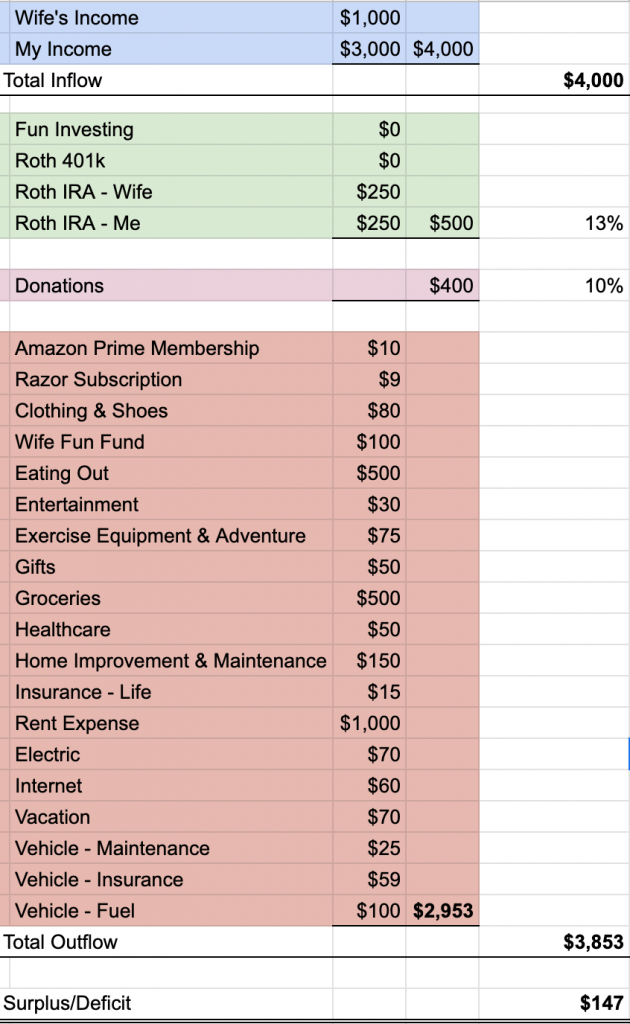

I always start by going into my accounting software and itemizing all of my expenses, giving, income, and investments and putting them into buckets. I do this using a software. You can do it in Mint, excel, google sheets, on a notebook, whatever. Here is the literal google spreadsheet template that I use for each month.

Is it simple? Yes. Because simple gets done and simple doesn’t break. Fancy stuff is complicated, time consuming, and ends up not getting done. This is the meat and bones of getting my financial life together. I track all income, all giving, and all investing. And I track all expenses. And I separate them to make sure I know how much of my life is spending, giving, investing, and income. It’s simple but IT WORKS. Which brings me to…

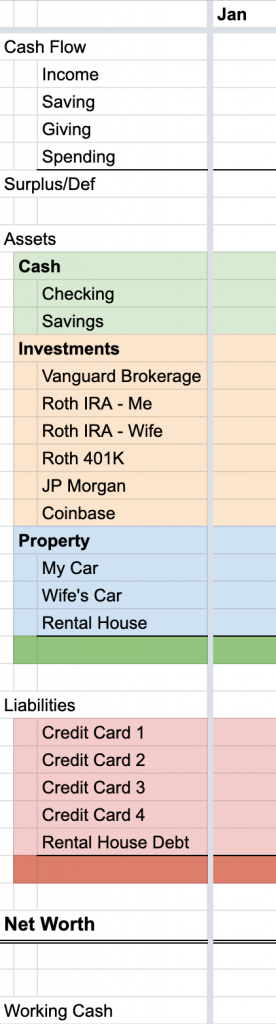

2. Track Net Worth & Cash Flow

This one is simple too. It’s one page in a spreadsheet that I use all year. The monthly above get their own tab for each month. This way, I get to see trends in income, saving, giving, and spending over the course of the year. And I also get to see how investment accounts grow (or shrink), credit card accounts grow or shrink, etc. This is my actual spreadsheet for net worth tracking.

(Working cash = Checking – Credit card balances) This is just a number to show me how much cash I have after paying off my credit cards.

The Absolute Minimum

If I lost you in the details, let me win your attention back here.

- Have a weekly spending review with your spouse (put it on a calendar and do it every week)

- Prior to that meeting, someone has to take responsibility for itemizing each transaction in your bank account and credit cards. Where did the money go?

- Track these things in a simple way ideally on a spreadsheet that makes sense to you (I shared mine above).

Remember – what gets measured gets managed. Building wealth is about discipline, not all about income. Trust me when I say that income without discipline will leave you equally as broke as the next schmuck that is too undisciplined to watch their spending. And heck, it’s not easy. And that’s why most people don’t do it. It’s also why most people are broke. But if you’re reading this, you probably aren’t that kind of person. Are you?

(P.S. if you’re having trouble getting this done, make a deal with yourself and your spouse that you get to go get a coffee and do this together.)

Pingback: November 2021 Spending Review - The Frugal Feline