The older I get, the more I am starting to see a particular pattern in life. This pattern is process. And for the purposes of this article, it’s antithesis is event. In this article, my aim is to prove to you that wealth is a process, not an event. Let’s begin.

I feel like I could write a book on this topic alone. But for the sake of the 3 readers who will read this article, I’ll get to the point.

Most people believe that events create wealth. I believe that process creates wealth.

I’d say most people don’t really buy this idea though. So I’d like to go ahead and make up a story to illustrate my point. The story of Will and Ben. The story of how wealth really is a process.

Will The One-Time-Wonder

Will is your typical private school kid. He grew up well off. Never really had to worry about money. He played football and always had the nice cleats. He was the kind of kid who got personal training in the off season.

Will came from an affluent family with a history of wealth. So Will never really had to worry about money and never discussed it with his parents. Money was just something they always had and never really had to think about. (I am sure we all have someone from our past who comes to mind.)

Will went to college and graduated debt free with a degree in Science thanks to a trust set up by his grandfather. Will was always smart with his money as an adult. He had a responsible lifestyle and never had to ask his parents for money. Unlike his brother and sister who were constantly taking handouts from their parents for down payments on cars and homes. (Again, I’m sure you don’t have to search too deep into your past to populate these characters with real people you know.)

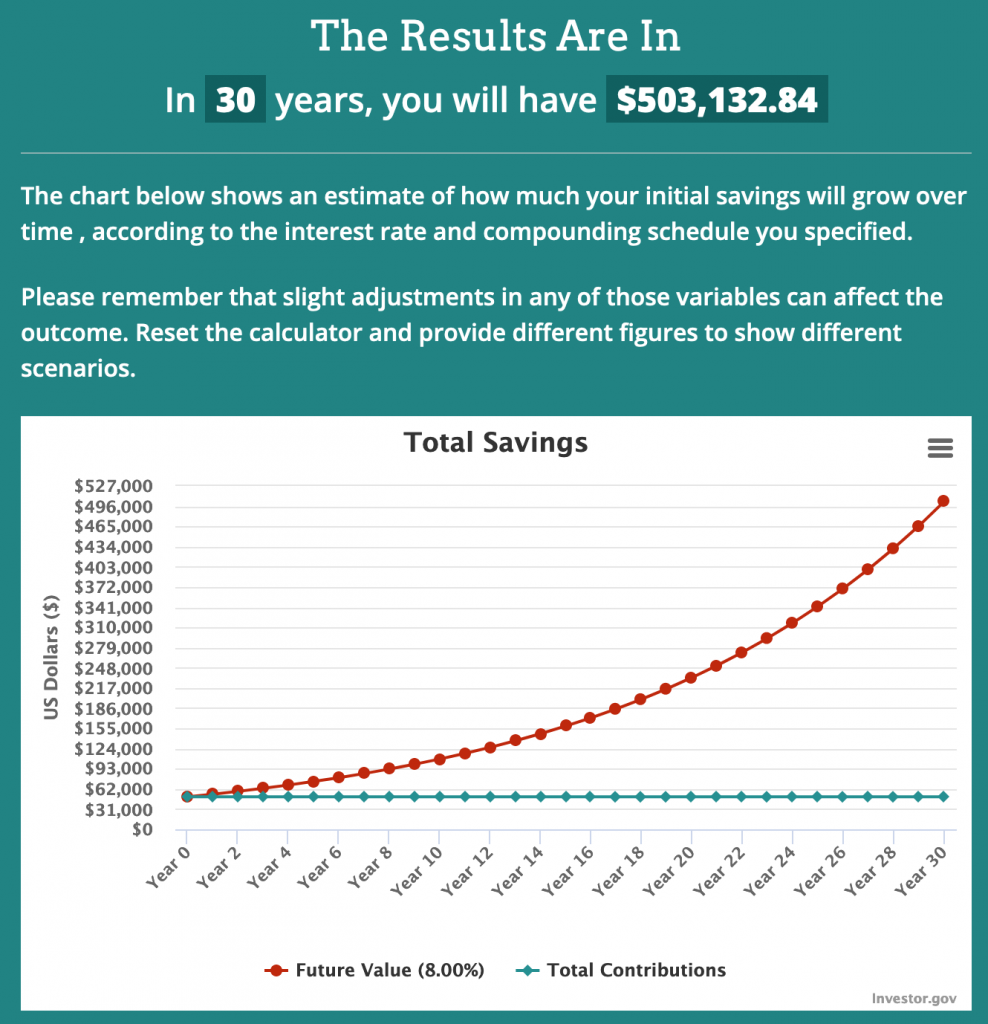

A few days after Will’s 30th birthday, his granddad on his mom’s side passed away leaving each grandchild with a nice fat $50,000 check. You can probably guess what Will’s siblings did with the money. But Will had always remembered learning the power of compound interest in school and vowed that when his inheritance finally came, he would invest every dime and not let it affect his lifestyle.

True to his word, Will invested the entire $50,000 in the stock market and vowed to leave it there until his retirement at 60 years old.

Good news for Will is, his big chunk of cash 10x-ed over the course of 30 years leaving him with a healthy half million in the bank come retirement.

By simply pretending like he never got that $50,000, Will had half a million at retirement.

Will’s situation is how many of us plan to invest. “We’ll do it when we get our annual Christmas bonus!” “We will invest when we get that inheritance!”

Will is the classic example of the category of person I believe most people fall into. Most people think that people get wealthy from events. A big bonus from work, selling a business, getting lucky on a stock, or inheritance from a family member.

But, without further adieu, let us illustrate the other bucket that individuals fall into. The bucket of people who believe that wealth is a process.

Ben The Budgeter

Ben has always been frugal. He grew up in a middle class family. Ben never had the nicest things and always had to work for what he got. He had always been a budgeter. After graduating from college, Ben had some school debt that he wanted to get rid of so he decided that, while he didn’t think he could save a whole lot each month, he could at least save $100 a week.

Ben’s friends laughed at his measly savings rate. $100 a week is less than most people spend on uberEats for goodness sake. But Ben was dead set that he would rather save a little than do nothing.

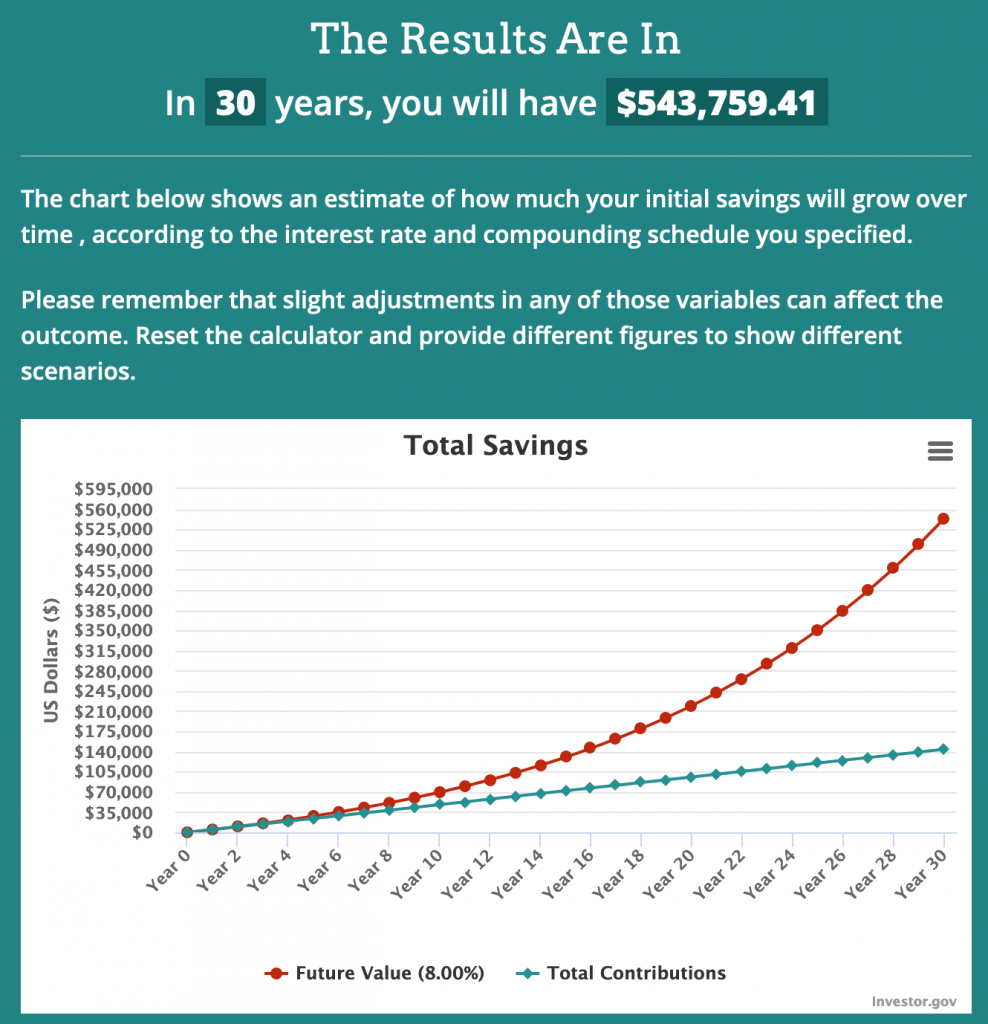

So, for 30 years Ben saved and invested $100 a week. That’s $400 a month and $4,800 a year. This was Ben’s only retirement plan. $100 a week from 30 years old to 60.

(Well, since you already know that this little story is fiction, I’m sure you won’t be surprised that Ben the Budgeter is going to come out on top. But what surprised me the most about this little example is how little it took to even be competitive with the 50k inheritance! Anyway, let’s continue.)

After 30 years of investing $100 a week in an index fund that made 8% annually (Same time in the market and rate of return as Will), Ben had a nest egg of over $540,000.

$100 a week. That’s it.

Over the course of those 30 years, Ben ended up contributing about $144,000 to his investment account, but thanks to the power of compound interest, he can cash out $543,759 worth of stock. Ben’s decision to buy $100 of assets a week for 30 years created an additional $400,000 to use in retirement.

Is wealth created from process or event?

Will got a big head start. He put a fat check for $50k in the market at the young ripe age of 30 while Ben started slow with $100 a week. The sad truth is, because of the power of compound interest, it’s true that Will’s money will have much more time to work hard for him and make him money. Will only put in $50,000 and 30 years later he had over $500,000 in his account. That’s $450,000 of pure, unadulterated interest right there.

Ben, on the other hand, was like the rest of us. He didn’t get big inheritances from rich grandparents. All Ben could do is a measly $100 a week. And, because it took Ben over 10 years to finally get as much as Will invested on Day 1, Ben had to contribute much more over the course of his 30 years of investing than Will did in order to outperform his investment portfolio.

30 years of $100 a week left Ben with $144,000 of his own cash invested ($94,000 more than Will) but to Ben’s pleasure, his measly $144,000 was actually worth $543,759 due to his investment returns.

What’s the Point?

The entire point of this comparison between Ben the Budgeter and Will the One-Time Wonder was to show that wealth can be achieved with a simple process – $100 a week.

Every single person reading this can find a way to free up $100 a week to buy assets. Everyone can. (In fact, to get the creative juices flowing – here’s an article on 16 easy ways to save more money each week.)

But most won’t. Many of you have already come up with an excuse as to why I’m wrong and why you actually can’t sacrifice the pleasure of spending $100 on crap you don’t need or food you can make yourself from home.

Most will continue to believe that they can only start investing some day when they make more money. Or when they finally get that inheritance they know is coming from Grandma, Grandpa, or Mom and Dad.

Conclusion – Is wealth a process or an event?

Honestly, it doesn’t matter what I think. It matters what you think. But if wealth was an event, wouldn’t all lottery winners still be wealthy? Wouldn’t all retired professional athletes be sipping mai tai’s on a beach somewhere?

What continues to surprise me is how often I notice the great things in life coming from processes and not from events. Process is what leads us to better jobs, fulfilling marriages, happy retirement, and healthy bodies.

Wealth is 100% a process. Right there along with health, relationships, and careers. The belief that you can’t start saving for retirement until you make more money or get a big check in your hand is a lie that will keep you poor and drain you of your hope for the future.

I’ll end with one of my favorite quotes that pretty much embodies the core of this post.

The difference between an amateur and a professional is that a professional writes every day while the amateur waits for inspiration to strike.

Steven Pressfield

I still haven’t gone pro in my writing. The only reason I finished this post is because inspiration struck.

But I’ve been auto investing for the last 2 years. I don’t wait for bonuses or for a time when I’m making more money. I set it and forget it. I’ve gone pro.